Bitcoin Contracts, Leverage and Margin, Spread, Bid and Ask Price

Lots & Contracts

Bitcoin Crypto is traded using standard contracts also known as lots. One standard contract or standard lot of Bitcoin is made of 1 unit of Bitcoin - 1 Bitcoin.

The Bitcoin Crypto Currency contract is the size of the amount of Bitcoins that are to be bought or sold in the online Bitcoin trading market by a Bitcoin Trader. The standard Bitcoin lot which is equal to 1 unit of bitcoin multiplied by the current price of Bitcoin is not traded physically, but this 1 unit of Bitcoin is represented by a contract.

These two terms, one standard lot and one standard contract can be used interchangeably because both refer to the same thing.

Why Trade Units of Bitcoins

The reason why 1 bitcoin contract is used to trade Bitcoin or BTCUSD is so as to make it easy for traders to transact Bitcoins between themselves online, since 1 contract represents one bitcoin, traders wanting to sell or buy can quickly place and open their trade positions and have the value of profits and losses made quickly settled using these contracts.

The Bitcoin Crypto price moves are measured in points - $1 dollar movement of Bitcoin will be represented by 1000 points move - meaning the market price of Bitcoin will be quoted to 3 decimal places - example if price of Bitcoin is $5530 on the software the price of Bitcoin will be quoted as 5530.000 - price quoted to 3 decimal places.

1 point of 1 unit of Bitcoin represents 0.1 Cents only, henceforth the price moves are calculated using very small price moves - Bitcoin, BTCUSD cryptocurrency will be quoted as $5530.000

The last digit is the point - the third decimal point.

Now, to answer why Bitcoin is traded in contracts, we shall use the example below to explain:

The BTCUSD cryptocurrency will only move an average of just about $100 dollars per day, this is equivalent to 100,000 points, if one point is equal to 0.1 cents, then trading a single unit of Bitcoin will only give profit of 100,000 points multiplied by 1 cent which is equal $100 dollars profit.

Bitcoin Contract

According to the current Bitcoin chart price at the time of writing, means 1 contract of Bitcoin is equivalent to 1*$5530.000 = $5530.000.

This means to buy 1 contract of Bitcoin at the current price a trader needs to have $5530.000 dollars in their Bitcoin trading account. But how does a retail trader who does not have a lot of money to invest get this amount of money?

But How Can any Trader afford $5,530.000 to Invest With?

That is a very good question; the answer is LEVERAGE and MARGIN

In Online Bitcoin trading, you do not need $5,530.000 Dollars to trade BTC/USD Crypto, with leverage & margin you only need $1,106 dollars to transact a contract of Bitcoin, but how?

We shall explain using the example below:

Leverage and Margin Bitcoin Trading

In Bitcoin Trading a small deposit can control a much larger transaction and this is what is known as Leverage, an option which gives BTCUSD traders the ability to make nice profits and at the same time keep their risks to a minimum because they'll only be using little of their money, A trader will trade Bitcoin contracts on borrowed capital, therefore a trader having a deposit of $1,106 dollars only can borrow the rest using a leverage option such as the 5:1 leverage option - which means that the trader can borrow $5 dollars for every $1 dollar in their trading account, to put it in simpler terms, the trader can borrow 5 times what they have deposited.

Therefore, a trader who only has $1,106 in their account can borrow up to 5 times their capital, therefore after borrowing, which is after using leverage the trader will now have $1,106 multiplied by 5 which is equal to $5,530.000 dollars. Now with the trader controlling $5,530.000 dollars they can then be able to trade the 1 contract of Bitcoin.

Leverage is represented in the form of a ratio, for example 5:1 means that an online Bitcoin trading broker will give a trader $5 dollars for every $1 that the trader has - that is the broker will give the trader the option to borrow 5 times the amount that they deposit. Leverage option of 5:1 also means the broker will give the trader an option to borrow 5 times the amount that they deposit in their trading account.

Margin - Margin is the amount of money required by your Bitcoin broker so that to allow you to continue trading with the leveraged amount. Margin is also the amount that you deposit when opening your account. For example when you deposit $2,000 then your margin is $2,000 dollars.

With leverage it is possible for retail Bitcoin traders or retail Bitcoin traders to trade the online Bitcoin market. Leverage option of 5:1 means that for every $1 dollar in your account you can borrow $5, this borrowed $5 dollars will be given to you by your online Bitcoin broker.

What this also means is that the broker also requires you to maintain $1 dollar in your account for every $5 that they have provided you with.

Bitcoin Contract Trading ExampleIf you deposit $5,000 in your trading account and your Bitcoin trading broker gives you leverage of 5:1 then it means you now have $5,000*5 = $25,000 dollars that you can transact with and even buy up to 4 Bitcoin contracts.

Because the total amount that you now control is $25,000 and your money is $5,000 which is equal to 20% of the total, it means your margin requirement is 20%.

A Bitcoin broker can tell you that their margin requirement is 20% which means that their leverage is 5:1, - 5:1 is the standard leverage option for Bitcoin trading provided by Bitcoin brokers.

Therefore, with leverage & margin as explained above it means that retail Bitcoin traders are not required to deposit all the cash for the whole contract that they are going to be trading with. The account they open they can trade on leverage & this account is known as a margin trading account - meaning they are trading on margin - the funds in their account is the margin for the leverage they will be using for trading.

Spreads

The spread is the difference between the price at which you buy & the price at which the online broker is offering to sell.

Spread can also be defined as the difference between the Bid Price and the Ask Price, the Bid Ask price illustrated below can be used to calculate the spreads for trading Bitcoin, BTCUSD cryptocurrency.

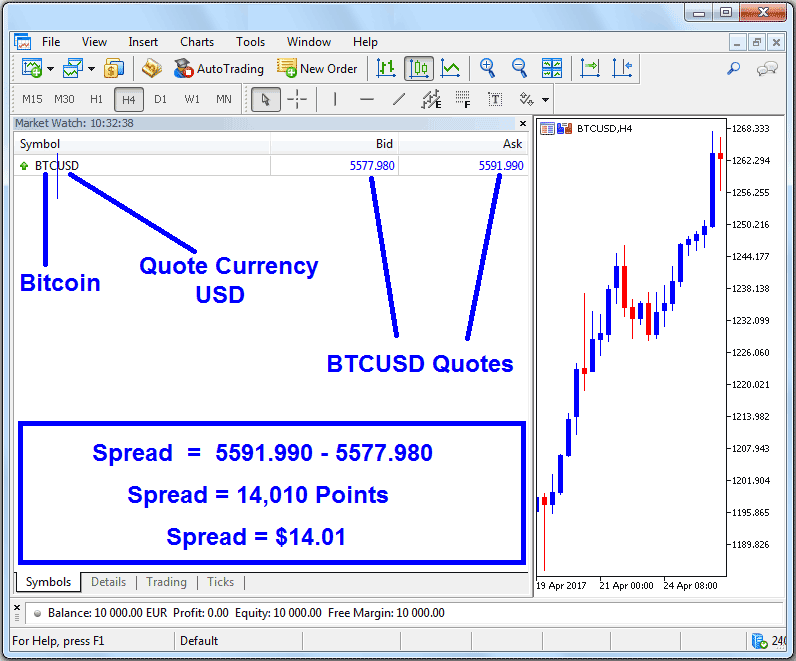

Bitcoin Trading Spreads on MT5

Example of How to Calculate Bitcoin Spreads

The Bid ASK Price of Bitcoin is 5591.990/5577.980

The spread is 5591.990 - 5577.980 = 14010

Spread is equivalent to $14.01

This spread is the profit that the Bitcoin broker makes.

Bid/Ask Price

Bid is the price at which you sell

Ask is the market price at which you buy

If the quote for BTCUSD is 5591.990/5577.980

Bid/Ask = 5591.990/5577.980

Therefore:Bid Price = 5591.990Ask Price = 5577.980

Mini Lots

As a note, there is also the fraction of 1 Lot in Bitcoin trading (1 lot is 1 contract), these fractions of the standard lot are provided by Bitcoin brokers so that to make Bitcoin more affordable to traders with minimum capital required being as little as $110.60 dollars to trade 1 mini lot - 1 mini contract.

The Fraction of a standard Bitcoin contract are called Mini Lot which is 1/10 of a standard Bitcoin contract.

Mini Lot = 0.1 Unit of Bitcoin

These mini Bitcoin trading lots were introduced to make the online Bitcoin Crypto Currency trading market more accessible to retail Bitcoin investor as well as attract more and more retail Bitcoin investors. Maybe this is why online Bitcoin trading has become very popular, even with as little as $110.6 dollars anybody can enter this market.

This is also another reason why Bitcoins are traded in contracts so that traders can also trade fractions of bitcoins - fractions of bitcoin contracts.

More Topics and Courses:

- How to Add Download MT5 Trading Expert Advisor EA in MetaTrader 5 Trading Platform

- Learn How to Install and Install BTC/USD MetaTrader 4 Trading Platform

- Exit Trade Signals & Setting Stop Loss Levels

- BTC USD Trade Training Program Download

- How to Use BTC USD Trade Platform Software Workspace

- What Happens in BTC USD after Bear Flag Pattern?

- BTC USD Place a Sell Limit BTC USD Order on MetaTrader 5 Platform

- Why BTCUSD Traders Choose STP Broker & The Difference Between STP and ECN BTC/USD Broker

- How Can I Open Live BTC USD Trade Account with $10?

- How to Analyze Upward BTCUSD Trend Reversal Signal