Bitcoin Market Hours and The 3 Major Bitcoin Sessions

Tokyo Close Charts

To maximize the number of trading opportunities during these Bitcoin hours, it is important to be aware of the times when the btcusd market is busiest. This is the time that most bitcoin trade activity occurs.

Even though there is no official open and close time during the week, it can be broken up into 3 major Bitcoin sessions - Tokyo, London & New York market sessions.

However, although it seems not to be very crucial at the start, the right time to trade is one of the most crucial points required to be a successful trader.

The best time is when the btcusd market is most active and therefore has the biggest volume of transactions. A more active market creates a good chance to make some profit while a calm and slow one is literally a waste of time - turn off your Desktop computer PC and don't even bother bitcoin trading at this time.

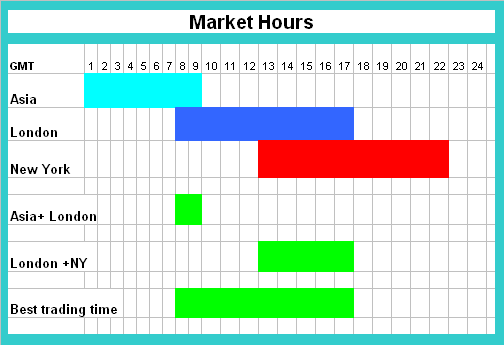

Not all the times are suitable, that is because the volatility keeps changing. Below is a table outlining the schedule of Bitcoin Crypto Currency Sessions. The time used is GMT 0

The three major market sessions are:

- Asian Session Hours( Tokyo ): 00:00 - 9:00 GMT

- European Session Hours( London ): 7:00 - 17:00 GMT

- U.S. Session Hours( New York ): 13:00 - 22:00 GMT

Bitcoin Sessions Overlaps

There are hours when 2 market sessions are overlapped:

London + Tokyo overlap - 7:00 - 9:00 GMT

New York + London over-lap - 13:00 - 17:00 GMT

At these over-lapping market hours you will find the highest volume of bitcoin transactions & therefore more chances to win during these hours.

This means that the lion share of bitcoin transactions is happening between the London market session and US session. Naturally this is the best time to make profits.

The bitcoin prices moves a lot during the New York & London Market Sessions because Multinational companies, hedge funds, managed funds and banks are open for transacting.

Multinationals will transact bitcoin during this time to facilitate international business transactions and commerce, hedge funds and managed funds will trade bitcoin for investment purposes, banks on the other hand will exchange a lot of money on behalf of their clients, maybe tourists wanting to travel around the globe or just anybody wanting to exchange their money so as to buy something in another country or make some transaction.

This makes the btcusd market very liquid at this time and the high volume of transactions means that bitcoin prices move a lot. At this time the charts will generally move in particular direction and form a short-term trend.

As a trader you also want to join in when everyone is placing their cryptocurrency orders as this is the time there is enough liquidity and many good opportunities to make money, and because there is a lot of liquidity the bitcoin price movement will generally be more predictable unlike when there is little liquidity and the bitcoin price movement becomes unpredictable and the bitcoin prices can move in a range bound with no particular direction.

Once you trade bitcoin for a while you will get to know that is easier to make money when the btcusd market is moving up or moving down, unlike when it's in a range.

Asian Session Characteristics:

- Least volatile of the three market sessions

- Account for 15 % of daily transaction turnover

- Typical 20 -30 pip moves

European Session Characteristics:

- Most volatile of the 3 market sessions

- 35 % of daily transaction volume

- Typical 90 -150 pip moves

USA Session Characteristics:

- 2nd most volatile of the 3 sessions

- Accounts for 25% of daily turnover

- Focuses on USA economic news

US and Europe Session Overlaps Characteristics:

- Combines the 2 most volatile sessions

- Accounts for 60 % of total daily transaction turnover

- Focuses on USA and European economic news

- Fast moving bitcoin prices and cryptocurrency trends in a particular direction

Learn More Topics & Lessons:

- What are the Different Types of BTC USD Traders?

- Candlesticks Chart BTC USD Crypto, Line Chart & Bar Chart Types

- How Do I Add Heikin Ashi Bitcoin Trading Indicator in Chart in MetaTrader 4 Platform?

- How Much Capital Does it Cost to Open a Mini BTCUSD Trade Account?

- Learn Bitcoin Chart Patterns Described with Examples

- MetaTrader 4 Momentum Bitcoin Trading Indicator for BTCUSD Trade

- BTC USD Equity Management in BTC USD Trade

- Types of Oscillator BTCUSD Trading Indicators

- No Deposit Bonus No Deposit Bonus BTC USD Account

- How to Open MetaTrader 4 Practice BTC USD Trade Account