CCI Bitcoin Trade Divergence BTCUSD Indicator Bitcoin Trading

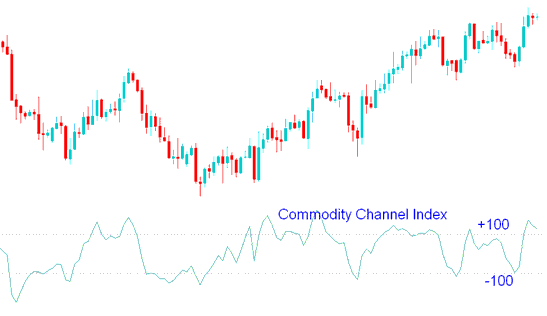

CCI indicator is one of the oftenly used divergence indicator. This btcusd indicator is an oscillator trading similar to the RSI and it can be used to trade divergence just the same way as the RSI.

CCI BTCUSD Analysis & Commodity Channel Index Trading Signals

Commodity Channel Index measures the variation of a commodity bitcoin price from its statistical mean ( statistical average ).

CCI indicator is an oscillator which oscillates between high areas and low levels

When the CCI is high it highlights that bitcoin price is unusually high when it's compared to its average.

When the CCI is low it highlights that bitcoin price is unusually low when it's compared to its average.

CCI BTCUSD Divergence Bitcoin Indicator BTCUSD Trading

CCI Bitcoin Trade Divergence BTCUSD Indicator Bitcoin Trading

CCI Divergence Indicator Bitcoin Crypto Currency Trading

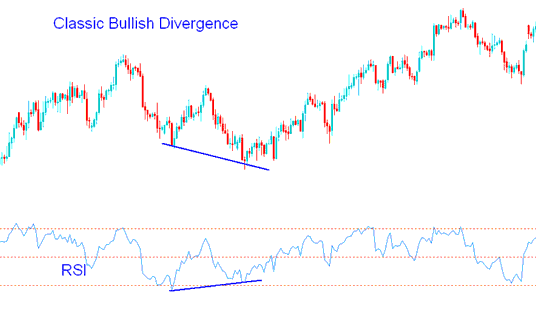

Classic CCI Bullish BTCUSD Divergence

CCI classic bullish divergence occurs when bitcoin price is forming lower lows ( LL ), but the Commodity Channel Index CCI trading indicator is making higher lows ( HL ).

Bitcoin Classic Bullish Divergence - Commodities Channel Index Divergence Indicator Trading

CCI indicator classic bullish divergence warns of a possible change in the bitcoin trend from down to up. This is because even though the bitcoin market price went lower the volume of the sellers who pushed the bitcoin price lower was less as shown by the CCI technical indicator. This is an indicator of the underlying weakness of the downwards trend.

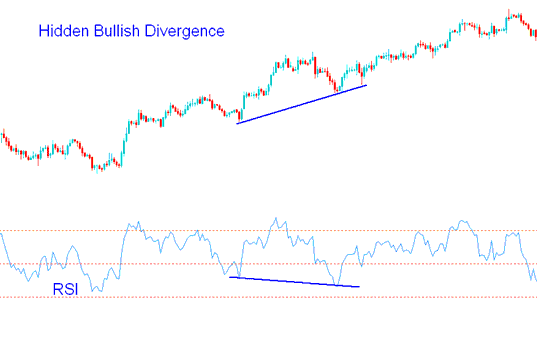

Hidden CCI Bullish Bitcoin Trade Divergence

Forms when bitcoin price is forming a higher low ( HL ), but the Commodity Channel Index CCI trading indicator is showing a lower low ( LL ).

CCI hidden bullish divergence forms when there is a price retracement in an upward trend.

Bitcoin Hidden Bullish Divergence - Commodities Channel Index Divergence Indicator Trading

This setup confirms that a price retracement move is exhausted. This Commodity Channel Index divergence shows under-lying strength of an upward trend.

CCI Divergence Indicator BTCUSD Crypto Trading

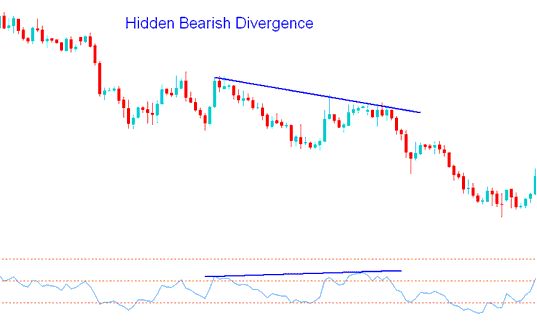

Hidden CCI Bearish BTCUSD Divergence

Forms when bitcoin crypto currency price is making a lower high ( LH ), but oscillator technical indicator is showing a higher high ( HH ).

Hidden bearish divergence forms when there's a retracement in a downward trend.

Bitcoin Trade Hidden Bearish Divergence - Commodities Channel Index Divergence Indicator Trading

This setup confirms that a price retracement move is exhausted. This divergence indicates strength of a downwards trend.

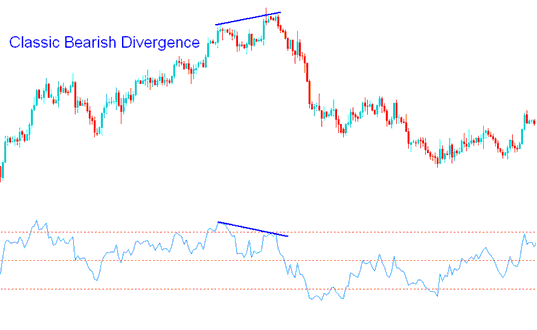

CCI Classic bearish BTCUSD Divergence

CCI classic bearish divergence occurs when bitcoin price is showing a higher high ( HH ), but the CCI indicator is forming lower high ( LH ).

Bitcoin Classic Bearish Divergence - Commodities Channel Index Divergence Indicator Trading

CCI indicator classic bearish divergence warns of a possible change in the bitcoin trend from up to down. This is because even though the bitcoin market price went higher the volume of the buyers who pushed the bitcoin price higher was less as shown by the CCI technical indicator. This is an indicator of the under-lying weakness of the upward trend.

Learn More Topics and Lessons:

- How to Download MT4 Bitcoin Platform Software for Windows

- How Do I Set Stop Loss Trade Orders in MetaTrader 4 Trading Platform

- Piercing Line BTC USD Candlesticks Tutorial Course

- Download Free BTC USD Trade Robot That Works for MT4 Platform

- Chart Trading Indicators & How to Trade with BTCUSD Trading Indicators

- Example of How is Margin Level Calculated on MetaTrader 4 Platform?

- How Do I Use Trade BTC USD Sell Stop Order on MetaTrader 4 Platform?

- BTC USD Profit Calculator Example

- How to Calculate BTC USD Trade Margin Formula