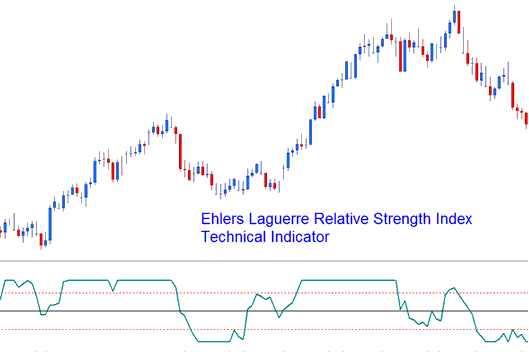

Ehler Laguerre RSI Bitcoin Analysis & Ehlers RSI Trading Signals

Developed by John Ehler.

Originally used to trade stocks and commodities.

Ehlers RSI uses a 4-Element Laguerre filter to provide a "time distort" such that the low frequency components/ bitcoin price spikes are delayed much more than the higher frequency components. This btcusd indicator enables much smoother filters to be created using short amounts of data.

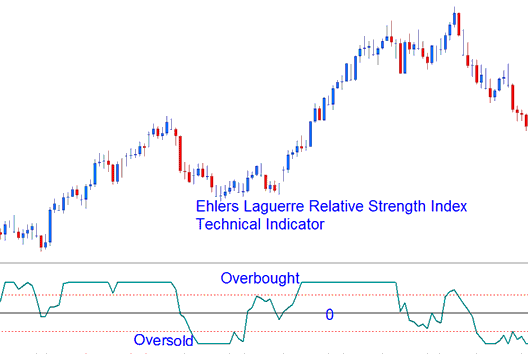

The Ehlers RSI uses a scale of 0- 100, the center-line is used to generate cryptocurrency signals and the 80/20 levels represents overbought/oversold areas.

Only parameter which can be optimized for this indicator is damping gamma factor, usually 0.5 to 0.85, to best suit your method.

Ehlers Laguerre RSI

Bitcoin Analysis and How to Generate Signals

This implementation of the Laguerre RSI uses scale of 0-100.

Bitcoin Crossover Trading Signals

Buy Trading Signal- A buy cryptocurrency signal gets generated when the Ehlers RSI crosses above the 50 level Mark.

Sell Trading Signal- A sell cryptocurrency signal gets generated when the Ehlers RSI crosses below the 50 level Mark.

Overbought/Oversold Levels on Bitcoin Indicator

Overbought/Over-sold Levels on Technical Indicator

A typical use of the Laguerre RSI is to buy after it crosses back above the 20 % level and sell after it crosses back below the 80 % level.

Study More Topics & Tutorials:

- How Can You Use Trading Bitcoin Sell Stop Order in MT4 Platform?

- Online BTCUSD Brokers Rankings & Reviews

- No Nonsense BTCUSD Trading Training Website Tutorial

- How Can You Analyze & Calculate Where to Set Stop Loss Order in Trading?

- How to Trade BTC USD Technical Indicator Signals

- How Can You Use Fibonacci Extension Levels in Bitcoin Charts?

- Trading Fibonacci Pullback Strategies