Drawing Fibo Retracement Areas on Upward and Downward Trend

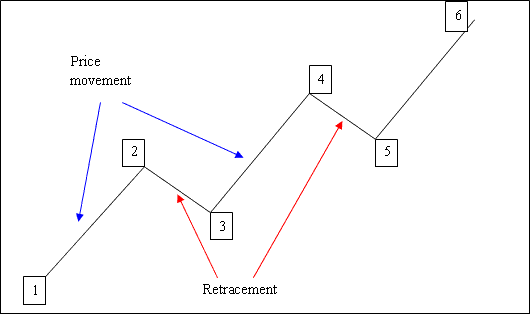

The bitcoin price on a cryptocurrency chart doesn't move up/down in a straight line. Instead it moves up or down in a zigzag pattern. Fib Retracement is the tool used to calculate where the zigzag will stop. The pullback levels are 38.2 %, 50 % & 61.8%. These form the points at which the btcusd trading market is likely to make a retracement.

What is a retracement? It is a pullback of the bitcoin price before the btcusd market resumes original trend/original direction of movement.

Examples of Zigzag Movement: The Example below shows bitcoin price moving up in a zigzag pattern.

The diagram below shows movement in an upward market.

1-2: Bitcoin Price moves up

2-3: Pullback

3-4: Moves up

4-5: Pullback

5-6: Moves up

Since we can spot where a pullback starts on a Cryptocurrency chart, how do we know where it'll reach?

The answer is we use Fib retracement tool.

This is a type of line study used in bitcoin trading to predict and calculate these levels. This btcusd indicator is placed directly on the cryptocurrency chart within the trading platform provided by your broker, This btcusd indicator will then automatically calculate these levels on the chart.

What are The Retracement Levels

- 23.6%

- 38.2 %

- 50.0%

- 61.8 %

38.20% & 50.00% Levels are the most used & most of the time this is where the pullback will reach. With 38.20% being the most popular and most widely used.

61.80% is also oftenly used to set stops for trades opened using this strategy.

This tool will be drawn in direction of the trend as described in the examples below.

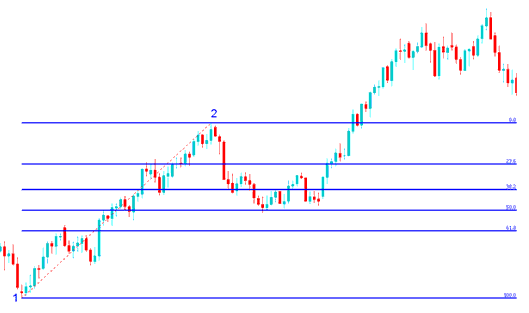

How to Draw on an Upwards Bullish Market

In the diagram below the bitcoin price is heading up between 1 and 2 then after 2 it retraces down to 50.00% pullback area then it continues heading up in the original upward trend. Notice that this indicator is drawn from point 1 to point 2 in direction of the bitcoin trend (Upward).

Because we know this is just a pullback based on strategy of using this technical indicator, we put a buy order just between the areas 38.2% and 50.0% and our stop loss just below 61.8% pull back mark. If you had put buy at this point in the trade example illustrated below you would have made a lot of pips.

Explanation for the Above Bitcoin Example

Once the trade hit the 50.0 percentage% level, this zone provided a lot of support for the bitcoin price, and afterward the btcusd trading market then resumed the original up bitcoin trend & continued to move upward.

23.60% provides minimum support and is not an ideal place which to open an order.

38.2 % provides some support but bitcoin price in this example continued to retrace upto the 50 % zone.

50.0% provides a lot of support & in this example, this was the ideal point to set a buy order.

For this example, the pullback reached the 50.00 % pullback area, but most of the time the btcusd trading market will retrace up to 38.2 % and therefore most of the time traders set their buy limit bitcoin orders at the 38.2 % level, while at the same time placing a stop just below 61.8 %.

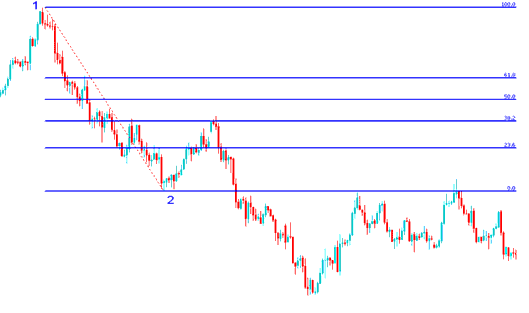

How to Draw on a Downwards Bearish Market

In the diagram below the btcusd trading market is moving down between 1 and 2, then after 2 it retraces up to 38.20 % retracement then it continues heading down in the original downwards trend. Notice that this indicator is drawn from point 1 to point 2 in direction of the bitcoin trend (Downwards).

Because we know this is just a pull-back we put a sell order at 38.20% level & a stop loss just above 61.8%.

If you had put sell order at the 38.2% level as illustrated on the trade below you'd have made a lot of pips afterwards. In this trade the retracement reached 38.20% point & did not get to 50.00% mark. From experience it is always good to use 38.2% because most times the pull-back does not always get to 50.00% mark.

Explanation for the Above BTCUSD Example

The above example is the perfect setup where the bitcoin price retraces immediately after touching the 38.2 % Level.

This zone provided a lot of resistance for the pullback, this was the best place for an investor to place a sell limit bitcoin order as the btcusd trading market quickly moved down after getting to this level.

Learn More Courses and Lessons:

- Trading Bitcoin Place a Pending BTCUSD Order in MT5 iPhone Trading App

- How Can You Analyze BTC USD Trend Signal on Bitcoin Chart Signals?

- How to Trade Different Types of Bitcoin Candles Patterns

- How to Trade Different Types of BTCUSD Candle Patterns Analysis

- How Can You Open Demo Account in MT4 Platform?

- 1 Min Time Frame Bitcoin Strategy

- How to Open Standard BTC USD Trading Account

- How to Trade MetaTrader 4 Bitcoin Pending Trade Orders in MT4 Platform

- How to Practice Trading BTCUSD on MT4 Bitcoin Demo Account

- Chaikin Money Flow BTCUSD Indicator Trading Analysis in Bitcoin Charts