How Do I Analyze Bitcoin System Bitcoin Signals?

How Do I Interpret Bitcoin System Bitcoin Signals?

Back Testing Bitcoin System Bitcoin Signals

Generating Bitcoin Trade Signals with a system is one of methods to trade bitcoin - it is one of the ways that a beginner bitcoin trader can attempt to determine the direction of the bitcoin trend with a good level of accuracy - and with a little bitcoin practice and back testing on bitcoin practice account so as to gradually increase the level of accuracy of this bitcoin system through practice bitcoin trading using the system.

The best method of how to backtest a bitcoin strategy is by following these two steps:

- Bitcoin Paper Method

- Cryptocurrency Demo Trade Technique

Bitcoin Paper Trading - bitcoin paper method of testing a bitcoin system involves placing your system on a chart - then take the chart back to a particular date - for example 3 months back, and then using this bitcoin chart bitcoin price history to determine where your system would have generated buy signals, sell signals and exit bitcoin signals. Write down these points on a bitcoin journal and also write the profit per bitcoin trade or loss per bitcoin trade and then calculate the total profit of loss after you have recorded a good number of trades generated by the bitcoin system such as 20 paper trades and determine if your system is overall profitable or not, the win ratio of bitcoin system, the loss ratio of your trading system & the risk:reward ratio of your system.

This is an ancient technique of testing bitcoin systems that was used by traditional investors when there was no online markets or desktop pc computers for that matter, the trader would use something like the A3 or A2 paper, graph format paper and draw the crypto charts manually (Imagine drawing the charts on your bitcoin platform by hand each day every hour, would you as a btc usd trader be ready to do that? - doubt it!) Those investors were hardworking than most, anyway for our paper method example, just a sample data of 20 cryptocurrency trades is all we need.

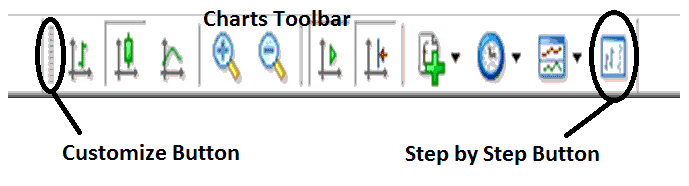

A good bitcoin tool to use to backtest your system is the MT4 BTCUSD Crypto Trade Step by Step Tool. Found on the MetaTrader 4 charts toolbar of MT4 software - If you want to find the charts toolbar on the MT4 platform it is at the top of MT4 software. If the charts tool-bar is not there: Press View (next to file, tops left corner of MT4 platform)>>> Tool Bar >>> Charts. Then click Customize button >>> Choose Bitcoin Crypto Currency Trade Step by Step >>> Press on Insert >>> Close.

How Do I Analyze Bitcoin System Bitcoin Signals

Crypto Trade with Crypto System Crypto Signals? - How Do You Read Crypto System Cryptocurrency Signals?

Once you get this MetaTrader 4 tool you can move your chart backwards, & use this MT4 tool - bitcoin trading step by step bitcoin tool - to move the crypto charts step by step while at the same time testing when your bitcoin system would have generated either a buy cryptocurrency signal or a sell bitcoin signal, & where you would have exited the trade, then write down on a bitcoin journal the amount of profit/loss per bitcoin trade and out of a sample number of trades you would then calculate the overall profits/losses generated by the bitcoin system.

If your trading system is profitable on the paper trade method then, it's time to open a demo trade account - demo bitcoin crypto currency trade & test if your system is profitable on the real market as it is on the paper method. This is known as the process of testing a trade system or backtesting a trade system.

Writing a BTCUSD Crypto Trade Journal

Write a Bitcoin Journal to keep track of the profitable trades and use the bitcoin journal to determine why these trades were profitable. Also keep a log of all losing cryptocurrency trades & use the bitcoin journal to determine why these trades made losses so as to avoid making these same mistakes the next time that you are trading using your system.

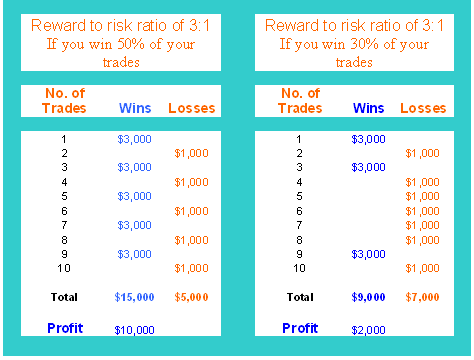

Tweak your bitcoin system until your bitcoin system gets a good risk: reward ratio - with the bitcoin signals that you generate with it. Aim to get a good risk: reward ration of 3:1 & a win ratio of above 70 % for your trading system is a good ratio, with proper bitcoin money management guide-lines even a bitcoin system with a win ratio of even 30% than is less than half of your trades make profit you can still make a profit using the proper bitcoin money management rules. You might want to learn the topic bitcoin money management to know what the illustration below is all about: Risk to Reward Ratio.

Crypto Trade with Cryptocurrency System Crypto Signals? - How Do You Read Crypto System Cryptocurrency Signals?

Learn Money Management Methods Guide

A manual system is still the best way to generate bitcoin signals compared to automated systems, a manual system is a better technique & is also much simpler to implement.

However, other bitcoin traders prefer automated bitcoin crypto currency systems & for those bitcoin traders - they can check the automated bitcoin information on this learn bitcoin webpage MQL5 EAs and Automated Bitcoin Systems.

You can also learn other bitcoin strategies to use in your bitcoin system from our list of bitcoin trade strategies topics that provides you with various methods of how to generate buy bitcoin signals & sell bitcoin signals using various analysis methods - Bitcoin Strategies List.

Crypto Trade with Crypto System Cryptocurrency Signals? - How Do You Read Crypto System Cryptocurrency Signals?

Learn More Lessons and Courses:

- How Do I Trade Fibo Pullback Technical Indicator?

- How Do I Add Trendline in Trade Software Platform?

- Technical Analysis of BTC USD Trading Indicators to Use in BTC USD Trade

- BTC USD Guide of How to Draw BTC USD Trend Lines in BTC USD Trade

- BTC USD 15 Minutes Chart Trade Strategy

- How to Analyze BTC USD Trading Indicator Signals

- How to Analyze Chart Patterns for Beginners