Trading Bitcoin Predict Chart Patterns Trend Reversal

How to Detect Patterns Trend Reversal Setups

Bitcoin trend reversal setups using Chart Patterns are used to predict bitcoin trend reversals using Bitcoin Chart Patterns.

Bitcoin Chart Patterns trend reversal signals are used to trading signal when the current bitcoin trend direction might reverse and begin heading in the opposite bitcoin trend direction.

The different Chart Patterns trend reversal setups that are used by traders to try & determine when the bitcoin price trend might reverse.

Among the different Chart Patterns - bitcoin reversal set ups which are used to spot bitcoin trend reversals in bitcoin trading are:

Cryptocurrency Chart Patterns Trend Reversals

Reversal chart patterns are patterns which form on the bitcoin price charts that are used to spot reversal bitcoin setups that signal potential bitcoin trend reversals.

Reversal bitcoin reversal cryptocurrency patterns - reversal chart bitcoin patterns are:

- Double Top Bitcoin Reversal Bitcoin Chart Pattern

- Double Bottom Bitcoin Reversal Bitcoin Chart Pattern

- Head & Shoulders Bitcoin Reversal Bitcoin Chart Pattern

- Reverse Head and Shoulders Bitcoin Reversal Bitcoin Chart Pattern

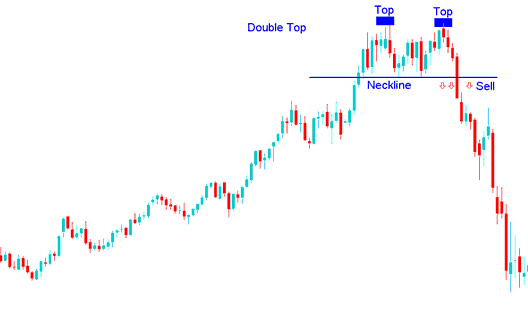

Double Top Reversal Bitcoin Patterns

Double tops reversal chart pattern is a reversal cryptocurrency pattern setup that forms after an extended upwards trend. As its name implies, this setup is made up of 2 consecutive peaks that are roughly equal, with a moderate trough in between.

How to Interpret Double Tops Chart Patterns Trend Reversals

Double tops reversal cryptocurrency pattern formation is considered complete once bitcoin price makes second peak & then penetrates lowest point between highs, called the neck-line. The sell cryptocurrency signal from this formation occurs when the bitcoin price breaks out below the neck-line.

In Bitcoin Crypto Currency, double tops reversal cryptocurrency setup formation is used as a early warning signal that a bullish bitcoin trend is about to reverse. However, it is only confirmed once the neck-line is broken & the bitcoin price moves below the neck line. Neck-line is just another term for the last support level formed on the Bitcoin chart.

Summary:

- Double tops reversal bitcoin pattern forms after an extended move upward

- Double tops reversal cryptocurrency pattern formation demonstrates that there will be a reversal in bitcoin price

- We sell when bitcoin price breaks out below the neckline point: see below for explanation.

How to Analyze Double Top Chart Patterns Trend Reversals?

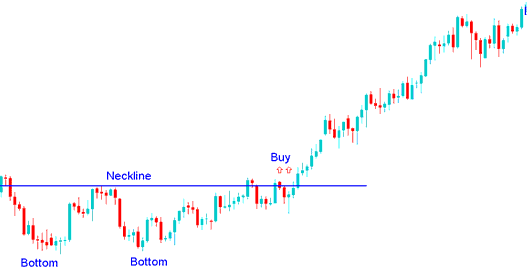

Double Bottoms Reversal Bitcoin Patterns

Double bottom reversal chart pattern is a reversal chart pattern that forms after an extended downwards trend. It's made up of two consecutive troughs which are roughly equal, with a moderate peak between.

How to Interpret Double Bottoms Chart Patterns Trend Reversals

Double bottom reversal cryptocurrency pattern formation is considered complete once bitcoin price makes second low & then penetrates highest point between lows, called the neckline. The buy indication from the bottoming out signal forms when the bitcoin price breaks the neckline to the upside.

In BTCUSD Crypto, double bottoms reversal cryptocurrency setup formation is an early warning signal that the bearish Bitcoin trend is about to reverse. It's only considered complete/confirmed once the neck-line is broken. In this formation the neckline is the resistance level for the btcusd crypto price. Once this resistance is broken the bitcoin price will move upwards.

Summary:

- Double bottom reversal bitcoin pattern forms after an extended move downward

- Double bottom reversal cryptocurrency pattern formation demonstrates that there will be a reversal in bitcoin price

- We buy when bitcoin price breaks above the neckline point: see below for explanation.

How to Analyze Double Bottoms Chart Patterns Trend Reversals? - Double Bottoms Patterns Trend Reversals

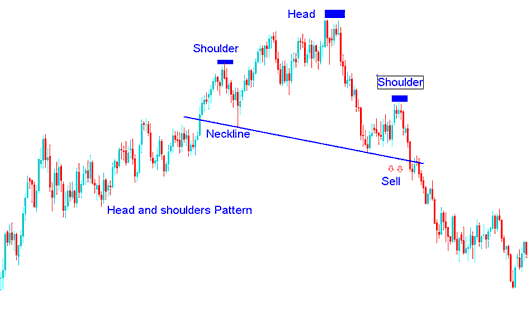

Head & Shoulders Reversal Bitcoin Patterns

Head & Shoulders reversal chart pattern is a reversal cryptocurrency setup that forms after an extended Bitcoin upwards trend. It's made up of three consecutive peaks, the left shoulder, head & the right shoulder with 2 moderate troughs between the shoulders.

How to Interpret Head and Shoulders Chart Patterns Trend Reversals

Head & Shoulders reversal chart pattern is considered to be complete once bitcoin price penetrates and moves below the neck line, which's drawn by joining the two troughs between the shoulders.

To go short, Bitcoin traders place their sell stop bitcoin trade orders just below neck line.

Summary:

- Head & Shoulders reversal bitcoin pattern forms after an extended move upward

- Head & Shoulders reversal cryptocurrency pattern formation demonstrates that there will be a reversal in bitcoin price

- Head & Shoulders reversal bitcoin pattern formation resembles head with shoulders thus its name.

- To plot the neckline we use chart point 1 and point 2 as shown below. We also extend this line in both directions.

- We sell when bitcoin price breaks out below the neckline point: see the chart below for explanation.

How to Analyze Head and Shoulders Chart Patterns Trend Reversals? - Head and Shoulders Patterns Trend Reversals

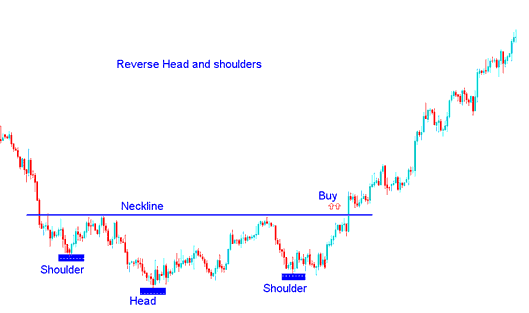

Reverse Head and Shoulders Reversal Bitcoin Patterns

Reverse Head & Shoulders reversal chart pattern is a reversal head & shoulders reversal cryptocurrency pattern setup that forms after an extended downward trend. It resembles an upside-down head shoulders.

How to Interpret Reverse Head and Shoulders Chart Patterns Trend Reversals

Reverse Head & Shoulders reversal bitcoin reversal chart pattern is considered to be complete once bitcoin price penetrates above the neckline, which is drawn by joining the two peaks between the reverse shoulders.

To go long buyers/bulls place their buy stop bitcoin trade orders just above neck-line.

Summary:

- Reverse Head and Shoulders reversal bitcoin reversal bitcoin pattern forms after an extended move downward

- Reverse Head and Shoulders reversal bitcoin reversal cryptocurrency pattern formation demonstrates that there will be a reversal in bitcoin price

- Reverse Head and Shoulders reversal bitcoin reversal chart pattern formation resembles upside down, thus the name Reverse.

- We buy when bitcoin price breaks above the neckline point: see the chart below for explanation.

How to Interpret Reverse Head and Shoulders Chart Patterns Trend Reversals? - Inverse Head and Shoulders Patterns Trend Reversals

Trading Bitcoin Predict Patterns Trend Reversal - Trading Bitcoin Predict Chart Patterns Trend Reversals - Trading Bitcoin Predict Patterns Trend Reversal Bitcoin Signals? - How to Detect Patterns Trend Reversal Setups

Get More Tutorials & Lessons:

- How Do I Use Fibo Extension in MetaTrader 4 BTCUSD Charts?

- BTC USD Trading Analysis in BTC USD Trade Courses

- What's MetaTrader 4 Demo BTC USD Trade Account?

- How Do I Analyze Fibo Extension in Trade Software Platform?

- Best Mini BTCUSD Account Brokers for Bitcoin Trade Beginners

- BTC USD Use Sell Stop BTC USD Order on MetaTrader 4 Platform

- Trade BTC USD Define a Bitcoin Trend

- How to Analyze MetaTrader 5 BTCUSD Charts Beginners Tutorial Course

- BTC USD MetaTrader 5 Insert Shapes in BTC USD Charts in MetaTrader 5 Platform

- BTC USD 15 Minutes Chart Trade Strategy