Japanese Bitcoin Candlesticks Pattern Setups Analysis

Japanese Candlestick PatternsBrief History

Candlesticks were developed in the 18th century by legendary rice trader known as Homma Munehisa to give the overview of opening, high, low & closing market btcusd crypto price over a given time period.

They were utilized by the legend rice trader to predict future market bitcoin prices. After dominating rice market, Munehisa then eventually moved to the Tokyo Exchanges where he then gained a huge trading fortune using this analysis. It's said that He made over 100 consecutive winning trades.

Types of Bitcoin charts

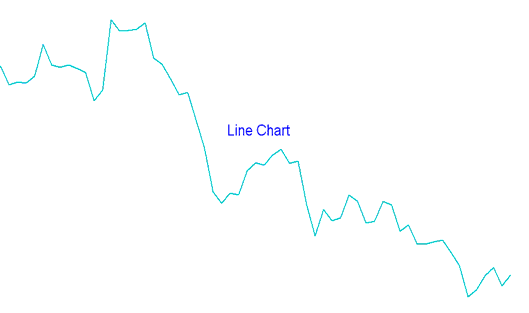

There are three types of charts used in Bitcoin: Line, bar and candles.

Line - plots a continuous line connecting closing bitcoin prices of bitcoin crypto.

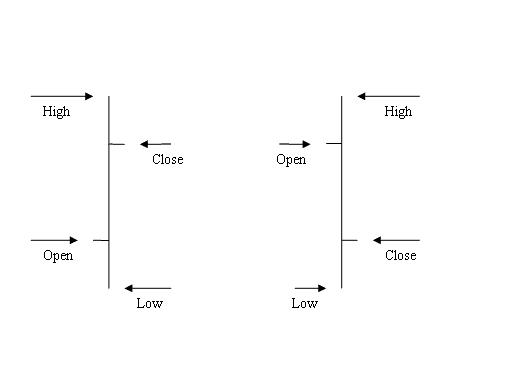

Bars- displayed as sequence of OHCL bars. OHCL represents OPEN HIGH LOW & CLOSE. The Opening btcusd crypto price is displayed as a horizontal dash on the left & closing bitcoin crypto currency price as a horizontal dash on the right.

The main disadvantage of a bars is that it's not visually appealing, henceforth most traders do not use them.

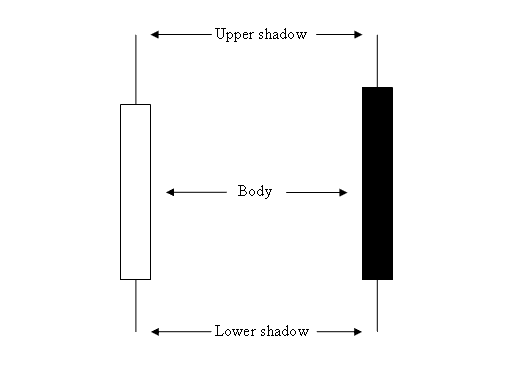

Candlesticks - these use the same bitcoin price data as bar crypto charts (open, high, low, and close). However, they are represented in a much more visually identifiable way which looks like a candle that has wicks on both its ends.

How to Analyze

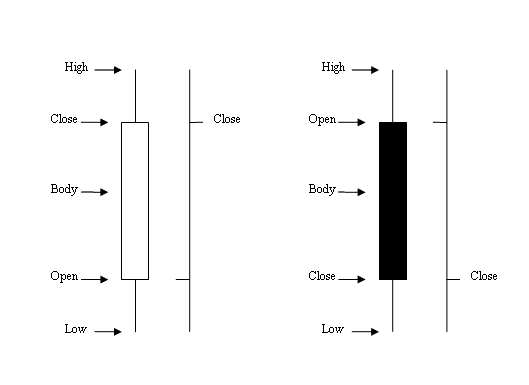

Rectangle section is called the body.

The high and low are described as shadows and drawn as poking lines.

The color is either blue or red

- (Blue or Green Colour) - Bitcoin Crypto Currency Prices moved up

- (Red Color) - Bitcoin Crypto Currency Prices went down

Most trading platforms like the MT4, use colour to mark direction. Colours used are blue or green: when btcusd crypto price moves up, red: when btcusd crypto price moves down.

Candlesticks Vs. Bar BTC USD Crypto Chart

When candles are used it is very easy to see if the bitcoin price headed up or down as opposed to when a bar Charts are used.

The Japanese techniques also have very many setups that are used to trade the BTCUSD Crypto market. These patterns have different trading analysis explanation & the most common are:

The above patterns is what makes the Japanese candlesticks popular among traders and it's why this type of analysis are most often utilized in analyzing the btcusd market. The analysis for these pattern setups in bitcoin crypto currency trade is the same as that one used in stocks trading.

Drawing These Charts on MetaTrader 4

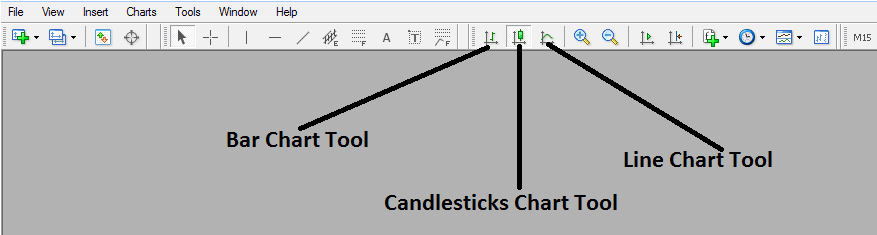

To draw these on the MT4, select the charts drawing tools within the "MetaTrader 4 Tool-Bar" - shown below.

To view this toolbar on MT4 navigate to the 'View' Next to file on the top-left corner of MT4 Software, Click 'View', Then Click 'ToolBars', Then check 'Charts' Button. Above toolbar will appear.

Once the above tool-bar, pops up you can then select the type you as the trader want to convert to, If you as a trader want to view using the bar chart format, click bar tool button as shown above, for line format click the line tool button, for Japanese candlesticks format click the "candlesticks tool button".

Get More Tutorials & Topics:

- How Do I Analyze Continuation Chart Patterns?

- How to Analyze 38.2% Fib Pullback Level on BTC USD Charts

- Rainbow Charts BTC USD Indicator Technical Analysis Trade

- How Do I Analyze Bullish Bull Flag Patterns Analysis?

- BTC USD Hanging Man Candlestick Pattern Guide

- How to Learn BTCUSD for Free Tutorial Course Training Website

- How to Analyze BTC USD Charts Analysis

- Learn Where to Learn Techniques of Trade BTC USD Crypto

- How to Install and Open the MetaTrader 5 Bitcoin Smart Phone BTC USD Trade App

- BTC USD Analysis Tools Used in Day Trading BTC USD Analysis