MACD Analysis

The MACD indicator was created by Gerald Appel.

MACD Bitcoin Indicator is one of the simplest and most commonly used technical indicators available. MACD Bitcoin Indicator is a momentum oscillator with some bitcoin trend following characteristics. Most popular technical analysis of MACD Bitcoin Indicator first calculates the difference between two moving averages and plots that as the MACD Bitcoin Indicator "Fast" line: A second MACD Bitcoin Indicator "Signal" (trigger) line - Bitcoin Signal is then calculated from the resulting "Fast" line & plotted in the same frame as the MACD Bitcoin Indicator "Fast" line. The "standard" MACD values for the "Fast" line are a 12-period exponential moving average and a 26-period exponential moving average MA and a 9-period exponential moving average MA for the MACD Bitcoin Indicator "Signal" line.

Interpretation of MACD Indicator - Bitcoin MACD Analysis

MACD Bitcoin Indicator is widely used as a bitcoin trend following technical indicator & tends to work most effectively when measuring wide swinging cryptocurrency market price movements. There are three basic techniques for using the MACD Bitcoin Indicator to generate trade signals.

MACD Crossover Signals:

1. MACD Bitcoin Indicator Fast line MACD Bitcoin Indicator Signal line Crossover: A buy bitcoin signal forms when the MACD Fast line crosses above the MACD Signal line and a sell btcusd signal gets generated when the MACD Fast line crosses below MACD Signal line.

2. Fast line / Zero-Level Crossover: - Bitcoin MACD Buy and Sell Bitcoin Signal Indicator When the MACD Fast line crosses above zero center line mark a buy bitcoin signal is given. Alternatively, when the MACD Fast line crosses below zero center line mark a sell bitcoin signal is given.

MACD Divergence Bitcoin Signal:

Bitcoin divergences between the MACD indicator & bitcoin price can prove to be a very effective bitcoin strategy in spotting potential bitcoin trend reversal and/or bitcoin trend continuation points in bitcoin price movement. There are several types of MACD indicator divergences:

MACD Classic Divergence Setup

- MACD Bullish Divergence = Lower lows in bitcoin price and higher lows in the MACD indicator

- MACD Bearish Divergence = Higher highs in bitcoin price and lower highs in the MACD indicator

MACD Hidden Divergence

- MACD Bullish Divergence = Lower lows in MACD and higher lows in bitcoin price

- MACD Bearish Divergence = Higher highs in MACD and lower highs in bitcoin price

MACD indicator Over-bought Over-sold Levels:

The MACD can be used to identify potential over-bought & oversold levels in bitcoin price movements. These MACD indicator overbought over-sold levels are generated by comparing the distance between the shorter moving average & the longer moving average: if the shorter moving average separates dramatically from the longer moving average it may be a signal that bitcoin price is over extending and the bitcoin price will soon return to more realistic levels.

Implementation of MACD Indicator

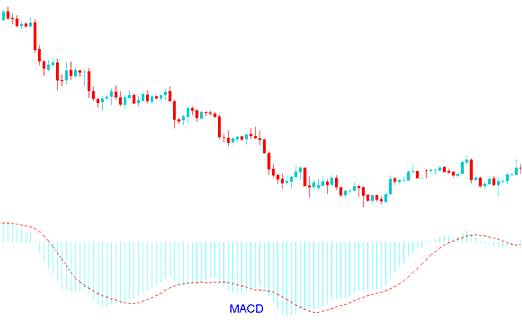

The MACD indicator Fast Line is drawn as a solid blueline. MACD indicator Signal Line is drawn as a solid red-line. A green histogram plot that represents the difference between the MACD FastLine & the MACD Signal Line has also been included to make identifying MACD indicator cross-over points easier.

Crypto MACD Indicator - MACD Analysis - MACD Strategy

More Lessons:

- How Can You Analyze MetaTrader 5 Upward BTC USD Trendline on MT5 BTC USD Trading Software?

- What is the Difference Between BTCUSD Cent & Standard BTC USD Account?

- Chandes Momentum Oscillator BTC USD Technical Indicator Analysis in Bitcoin

- How to Draw Fibonacci Pullback Levels on Upwards BTC USD Trend & Downwards BTC USD Trend

- Writing BTCUSD Trading Journal Book

- How to Trade Fibo Pullback Levels Trading Indicator

- Set Buy Limit BTC USD Order & Sell Limit BTC USD Order in MT5 Software

- MT4 Trading System Tester Download Data

- How Can You Login to MT5 Trade Account?

- How Can You Draw BTCUSD Channels in MT4 Platform?