Parabolic SAR BTCUSD Analysis & Parabolic SAR

Developed by J. Welles Wilder & is used to set trailing bitcoin trading price stops. This Trailing StopLoss Bitcoin Order Indicator was originally developed to analyze trending Bitcoin Trading Markets. It's drawn as a chart overlay trading indicator, that is on the bitcoin trading price chart itself.

This is a very accurate indicator for providing exit points and thus it is used to set trailing stops and is usually referred to as 'SAR' (stop-and-reversal) - Trailing Stop Loss Bitcoin Order MT4 Indicator.

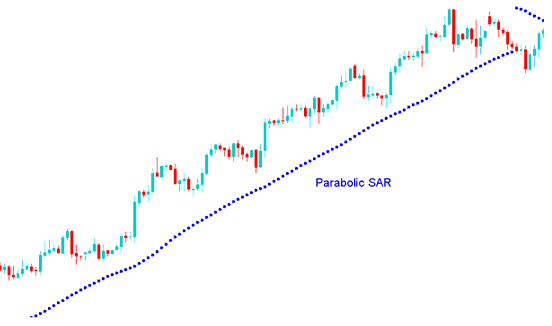

This Trailing Stop Loss Bitcoin Order MT4 Indicator is drawn above or below the bitcoin trading price - it's drawn as a series of dots. The length of movement of SAR is determined by scale of bitcoin trading price movement.

In an upwards Bitcoin trend the parabolic SAR will be below the bitcoin trading price. As long as the up bitcoin trend continues then SAR will continue to being below the bitcoin trading price - Trailing Stop Loss Bitcoin Order Indicator. When bitcoin trading price move down & the parabolic SAR goes above the bitcoin trading price then the Bitcoin trend reverses to bearish.

This trailing stop loss technical indicator uses a parabolic calculation to draw the sequence of dots, This means that if the bitcoin trading price stops moving upwards with the same acceleration, the parabolic SAR will continue with same acceleration thus at some point bitcoin price will hit the indicator if it slows down too much.

Explanation

This Trailing Stop Loss Bitcoin Order MT4 Indicator provides excellent exit points. You should close long positions when the bitcoin trading price falls below the SAR and close short positions when the bitcoin trading price rises above it.

If you are long, the Parabolic SAR - Trailing Stop Loss Bitcoin Order MT4 Indicator will move up every day, regardless of direction the bitcoin trading price is moving. The amount this indicator moves up depends on the amount that bitcoin trading prices move.

The same trading analysis will also apply to a downwards btcusd crypto trend, the parabolic SAR - Trailing Stop Loss Bitcoin Order MT4 Indicator will be above the bitcoin trading price & it should remain above the bitcoin trading price til the bearish down bitcoin trend reverses.

The chart below shows example of the Parabolic SAR in an up btcusd crypto trend market, You can check how it trailed below bitcoin trading price (Bullish Bitcoin Trading Market) until when it was hit & the Bitcoin trend reversed.

Learn More Tutorials & Topics:

- How Do I Analyze BTC USD Trade Price Action BTC USD Strategies?

- MetaTrader 5 Bitcoin Platform Software Support Resistance BTC USD Trading Indicator MT5 Charts

- MetaTrader 5 Gann Lines BTC USD Trading Indicator

- MetaTrader 4 Bitcoin Platform Software Tutorial Candlesticks Chart Analysis BTC USD Trade Tutorial Course

- BTC USD Trade Strategy for Beginners

- How to Analyze BTC USD Trade Candlesticks Patterns BTC USD Strategies

- How to Learn Bitcoin Platforms for Mobile Phones

- Account MetaTrader 4 Trading Platform Trading Account Login

- How to Analyze the Difference between Fibo Pullbacks Levels & Fibonacci Extensions Levels

- How to Analyze 38.2% Fib Pullback Level on BTC USD Charts