Stochastic Oscillator Technical Bitcoin Analysis & Stochastic Oscillator Signals

Developed by George C. Lane

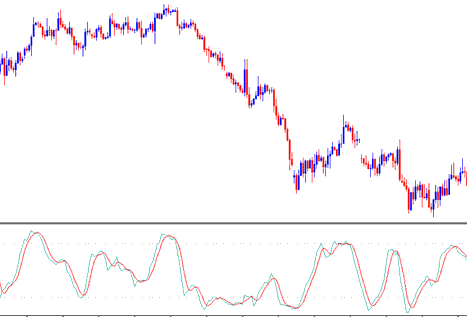

Stochastic Oscillator Technical Indicator is a momentum indicator - it shows the relation between the current closing bitcoin price relative to the high & low range over a given number of n periods. Oscillator uses a scale of 0-100 to draw its values.

This Oscillator is based on the theory that in an up bitcoin trend market the bitcoin price closes near high of the bitcoin price range & in a downwards trending market the bitcoin price will close near the low of the bitcoin price range.

The Stochastic Lines are drawn as 2 lines- %K and %D.

- Fast line %K is the main

- Slow line %D is the signal

3 Types of Stochastics BTCUSD Oscillators: Fast, Slow & Full Stochastics

There are 3 types are: fast, slow and full Stochastic. 3 indicators look at a given chart period for example the 14-day period, & measures how the bitcoin price of today's close price compares to the high/low range of the time period that is being used to calculate the stochastic.

This oscillator works on the principle that:

- In an up-ward bitcoin trend, bitcoin price often tends to close at the high of the candlestick.

- In a downwards btcusd crypto currency trend, bitcoin price tends to close at the low of the candlestick.

This btcusd indicator shows the momentum of the Bitcoin trends, and identifies the times when a market is over-bought or oversold.

Bitcoin Analysis and Generating Signals

Most common techniques used for trading analysis of Stochastic Oscillators to generate cryptocurrency signals are cross overs signals, divergence signals and over bought over-sold areas. Following are the techniques used for generating trading signals

Bitcoin Trading Cross-over Trade Signals

Buy signal - % K line crosses above the %D line (both lines moving upwards)

Sell signal - %K line crosses below %D line (both lines moving downwards)

50-level Crossover:

Buy signal - when the stochastic indicator lines cross above 50 a buy bitcoin signal gets generated.

Sell signal - when stochastic indicator lines cross below 50 a sell bitcoin signal gets generated.

Divergence BTCUSD Crypto Currency Trading

Stochastic is also used to look for divergences between this indicator & the bitcoin price.

This is used to determine potential bitcoin trend reversal bitcoin signals.

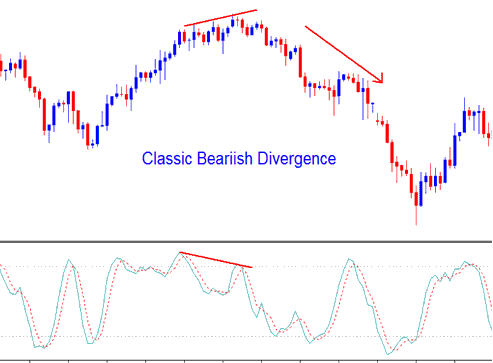

Upwards/rising bitcoin trend reversal - identified by a classic bearish divergence

Bitcoin Trend reversal - identified by a classic bearish divergence

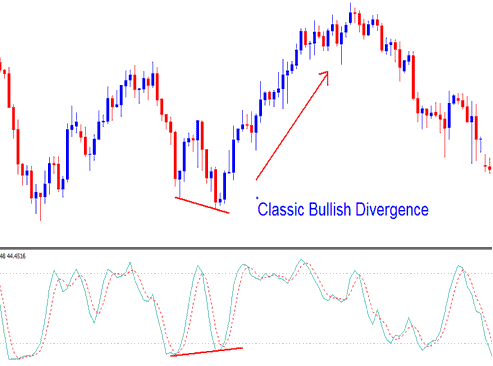

Downward/descending bitcoin trend reversal - identified by a classic bullish divergence

Bitcoin Trend reversal - identified by a classic bullish divergence

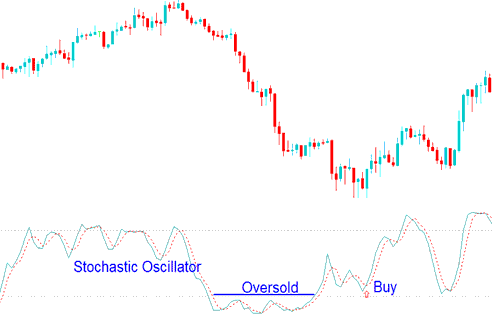

Overbought/Over-sold Levels on Technical Indicator

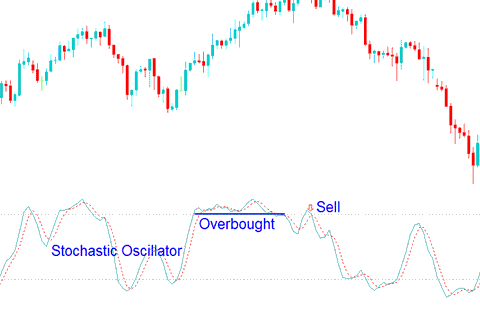

Stochastic is mainly used to identify potential overbought and oversold conditions in bitcoin price movements.

- Overbought values greater than 70 level - A sell cryptocurrency signal forms when the oscillator rises above 70% and then falls below this level.

Overbought - Values Greater 70

- Oversold values less than 30 level - a buy cryptocurrency signal gets generated when the oscillator goes below 30% and then rises above this level.

Over-sold - Values Less Than 30

Trades are generated when Stochastic Oscillator Technical crosses these levels. However, overbought/oversold levels are prone to whipsaws especially when the btcusd market is trending upward or downwards.

More Lessons and Tutorials: