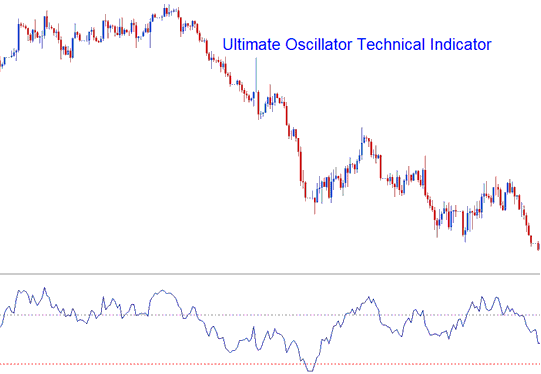

Ultimate Oscillator Bitcoin Analysis & Ultimate Oscillator Technical Trading Signals

Originally developed and used to trade stocks & commodities markets.

This oscillator aims at striking a balance between leading signals & lagging signals given by the common technical indicators.

- Leading - some indicators lead the btcusd market and give signals earlier than the optimum time

- Lagging - some indicators lag the btcusd market so far that half of the move is over before a signal gets generated.

This is the balance that the oscillator aims to strike, not to lead too much or lag too much - this way the oscillator trading will always give a signal at the ultimate time, thus its name.

This btcusd indicator uses 3 different n-number of candlesticks and calculates the combined weighted sums of bitcoin price action from these candlesticks and plots these values a scale ranging from 0 to 100. Values of above 70 are considered to be overbought levels while values of below 30 are considered to be over-sold levels.

The time periods used to calculate the ultimate oscillator trading are 7 periods (short term trend), 14 periods (intermediate term trend) and 28 periods (long term trend).

Bitcoin Crypto Currency Analysis & Generating Trading Signals

This Bitcoin technical indicator can be used in generating buy & sell trading signals using different methods.

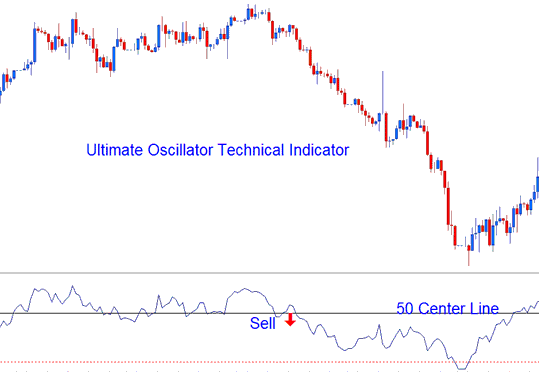

Center line Bitcoin Cross-over Trade Signal

Buy Bitcoin Signal - values above 50 center line level

Sell Bitcoin Signal - values below 50 centerline level

Center line Bitcoin Cross-over Trading Signal

Overbought/Over-sold Levels on Technical Indicator

Overbought - levels above 70 - sell bitcoin trading signal

Oversold - levels below 30 - buy bitcoin trading signal

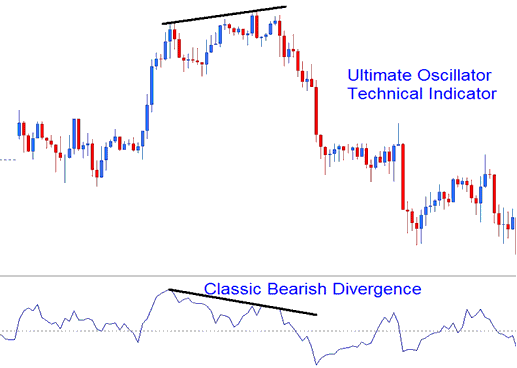

Divergence BTCUSD Trading

The oscillator trading can also be used to trade divergence signals, below is an example of a classic bearish divergence signal.

Technical Analysis

More Lessons & Tutorials:

- How to Trade Bitcoin Head & Shoulders Pattern

- RSI Hidden Divergence BTCUSD Trading Strategies

- How to Load a Profile of MT4 BTCUSD Charts in MT4 Platform

- Fibonacci Pullback Levels on BTCUSD Charts Tutorial Course

- What Happens in BTCUSD after an Up Bitcoin Trendline is Broken?

- Parabolic SAR Combination of Bitcoin Technical Indicators

- How to Read Falling Wedge Chart Pattern Explanation

- How to Trade Resistance & Support Levels in Day Trade

- How Can You Use Fibonacci Pullback Levels Trading Indicator in MT5 Software?

- BTCUSD Trendline Technical Indicator MetaTrader 4 Bitcoin Software