What Happens in Bitcoin after a Hammer Bitcoin Candlesticks Pattern?

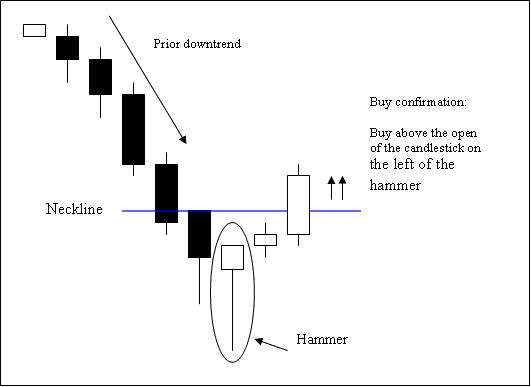

Hammer candlestick pattern setup is a potentially bullish candle set-up which occurs during a downwards trend. It's named so because the btcusd cryptocurrency market is hammering out a bottom.

A hammer btcusd crypto candlestick pattern has:

- A small body

- The body is at the top

- The lower shadow is two or three times length of real body.

- Has no upper shadow or very small upper shadow if present.

- The color of the body is not important

What Happens in Crypto after a Hammer Crypto Candlesticks Pattern?

Analysis of Hammer Bitcoin Candlesticks Pattern

The bullish reversal buy cryptocurrency signal is confirmed when a candlestick closes above the opening bitcoin price of the candlestick on the left of this hammer candlestick pattern.

Stop loss orders should be set a few pips just below the low of the hammer candlestick once a trade is opened using this candlesticks pattern formation.

Study More Topics & Lessons:

- How to Save MetaTrader 4 Chart Template Explanation

- Swing 4 Hour Swing Using the 4 Hour Bitcoin Swing Checklist

- What are the Different Types of BTC USD Traders?

- Risk Management BTC USD Trade Techniques in BTC USD

- BTC USD Broker Account with Account Opening Bonus

- Best BTC USD Trade Market Session Hours Described

- BTC USD Trading Indicator System

- BTC USD Set Take Profit BTC USD Order on MetaTrader 5 Android App

- What's Marubozu Candlestick Patterns in BTC USD?

- How to Download MT5 BTCUSD Platform Software for Mac PC