Is Inverted Hammer Candlestick Pattern Bullish or Bearish?

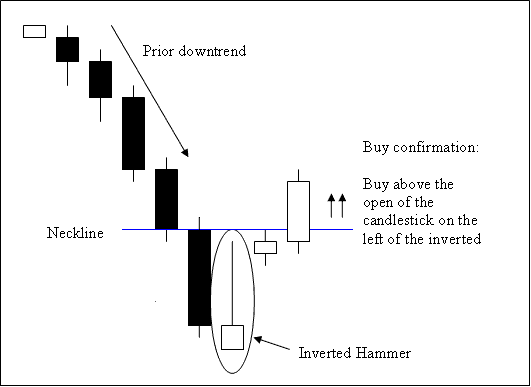

Inverted Hammer candle-sticks setup is a bullish reversal candlestick pattern. It forms at the bottom of a Crypto trend.

Inverted Hammer candle-sticks setup occurs at the bottoms of a down bitcoin trend & indicates possibility of reversal of the downwards trend.

Inverted Hammer Bullish Crypto Candlesticks Setup

Analysis of Inverted Hammer BTCUSD Crypto Candle Pattern

A bullish reversal buy crypto signal is confirmed when a candlestick closes above the neck-line, this is the opening of the candle-stick on the left side of this inverted hammer candles setup. The neckline in this case is a resistance area.

Stop orders for the buy trades should be set a couple of pips below the lowest bitcoin price on the recent low once a btc/usd trader opens a trade transaction based on this candles setup. An inverted hammer cryptocurrency candlesticks pattern is named so because it signifies that the btcusd market is hammering a bottom.

Study More Tutorials & Courses:

- How to Analyze Trade MetaTrader 4 Trading Platform Tutorial Guide Chart Analysis Beginners Guide

- The Basis of BTC USD Analysis & What BTC USD Analysis is all About

- Where Can I Learn Bitcoin Trading Analysis for Beginners?

- 3 Bollinger Bands Bitcoin Trade Strategies

- How to Analyze MetaTrader 4 Bitcoin Charts for Beginners

- How to Practice Trade BTC USD in MetaTrader 4 Bitcoin Demo Practice Account

- How Do I Analyze Fibo Pullback Technical Indicator on MetaTrader 4 Platform?

- How Do I Use Fibo Pullback Levels Trading Indicator on MetaTrader 5 Platform?

- How Do I BTC USD Sign Up a Live BTC USD Account?

- How to Open Demo Practice Account in MetaTrader 4 Trading Platform Tutorial Guide