Where to Buy

A trader should know when to open a buy order, just because the btcusd trading market is bullish and bitcoin prices are heading upward it doesn't mean you can just buy anywhere. You need to know art of where to open a buy order.

Consider this, the btcusd trading market is bullish you come and buy at the top of the bitcoin trend where the bitcoin trading prices look so bullish that it creates the illusion that the btcusd trading market will never retrace and if you do not buy now you will be left behind, only that just after you buy the btcusd trading market immediately retraces 200 pips. This is not the art of how to buy. Even if the btcusd trading market goes up and the btcusd trading market bitcoin price returns to where you bought you are still not in profit, you have done zero work and you have just wasted your time. You need to know where to buy at the best bitcoin price & at the best time so that the btcusd trading market does not retrace on you just when you have bought.

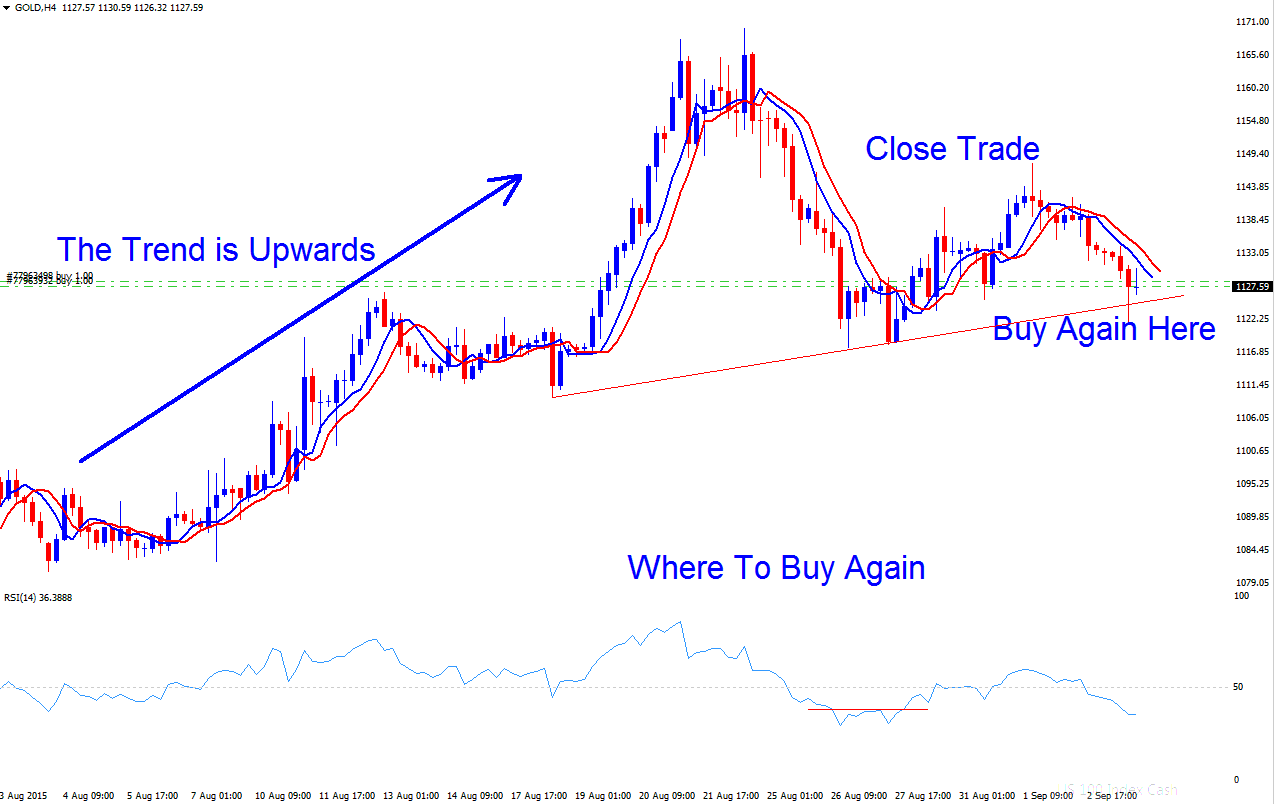

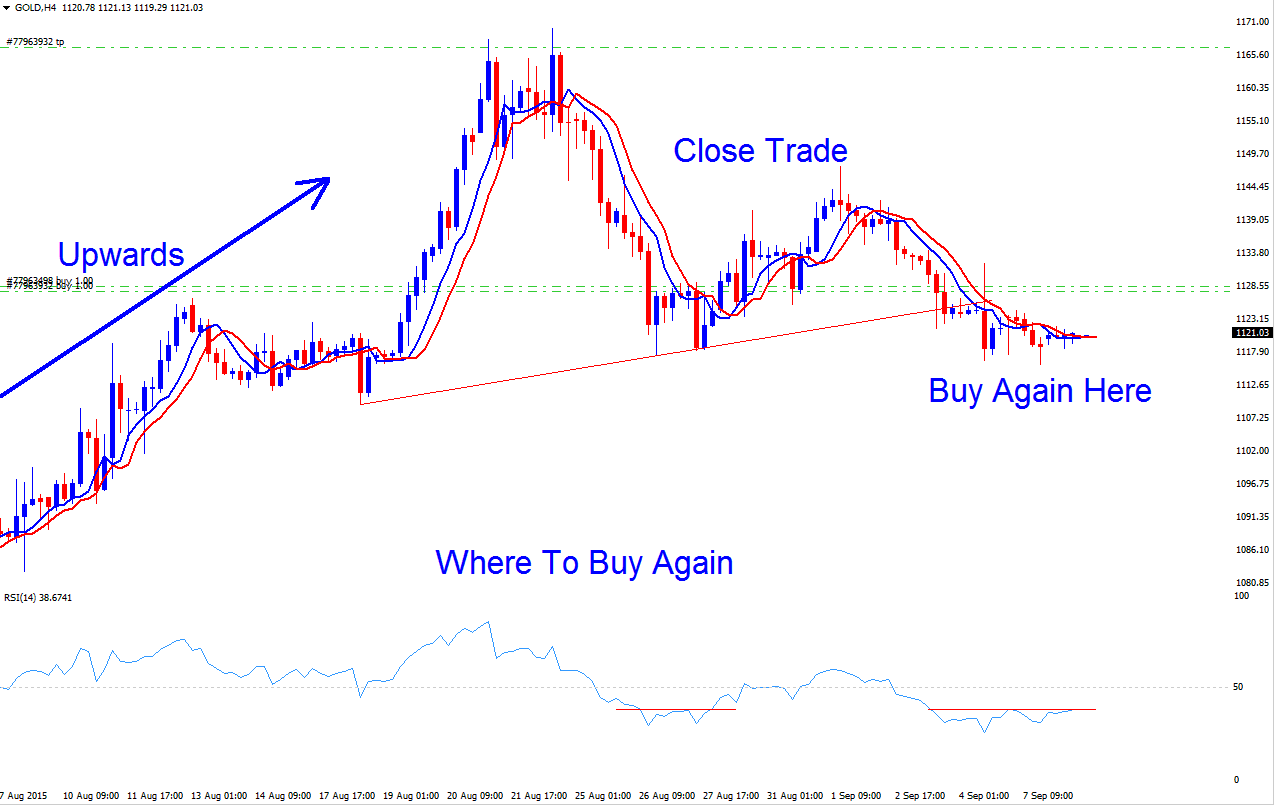

The chart below shows an upward trending market. It shows where most traders buy, most traders buy when the upwards market is looking obvious, this isn't where to buy, you buy when the btcusd trading market bitcoin trend is not looking obvious, this is when there is a retracement in the bitcoin price. Always aim to buy after a retracement as shown below.

The art of this type of buying is which you buy after a retracement, henceforth even if bitcoin price does not move up immediately, the retracement will already be played out halfway or 3 quarter way, henceforth instead of you entering a buy which retraces 200 points as in the case that you buy at the top, you buy after a retracement therefore even if bitcoin price were to retrace on you it will only retrace a few points and once the bitcoin trend resumes you will make profit much faster.

For example if you buy after the bitcoin price has retraced 150 points and the total retracement is 200 points, then you buy position will only retrace on you by 50 points instead of 200 points. And by the time the upward bitcoin trend resumes and bitcoin prices moves up 200 points to clear the retracement at this point you will be 150 points in profit, thus you'll have saved time as well as by entering at the best point you will make money on the retracement. This is the art of buying if you want to make money when trading an upward trending market.

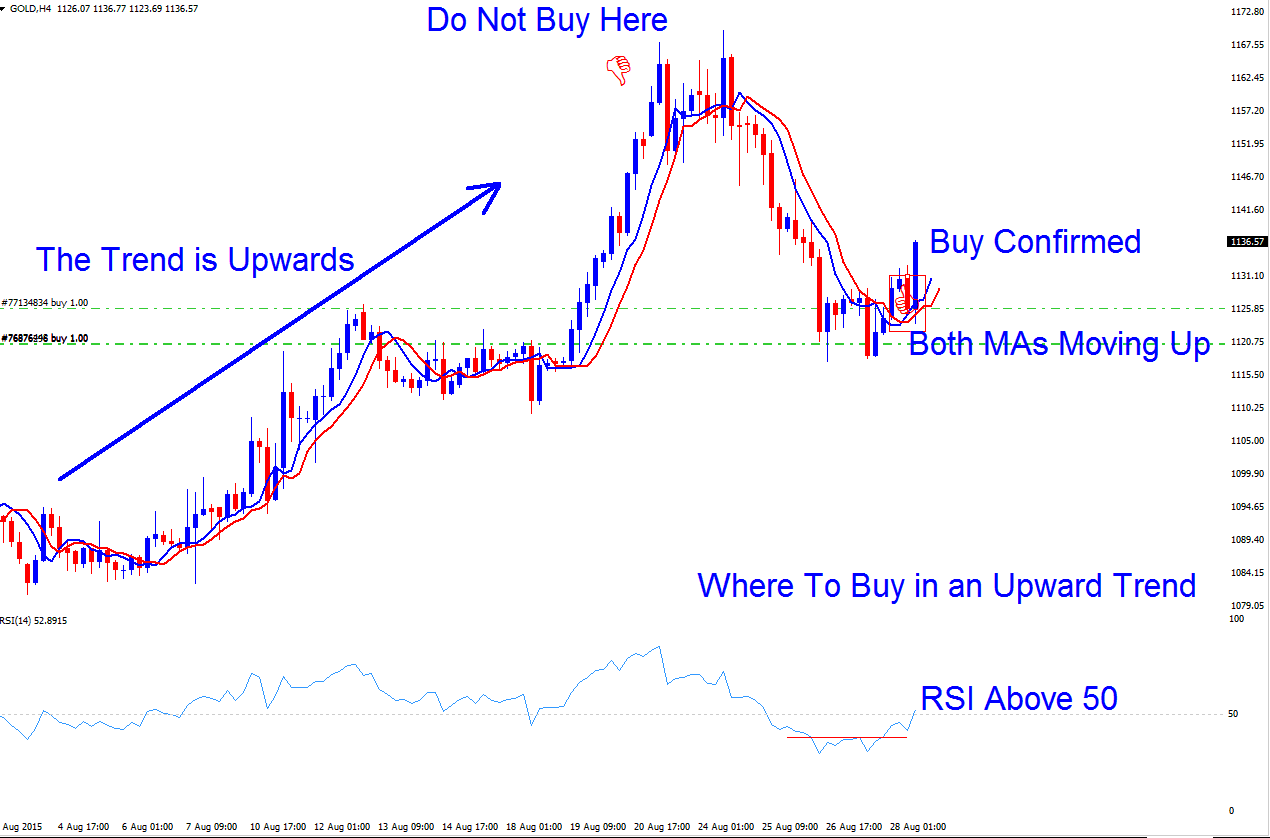

The example illustrated below shows where to not to buy and where to buy after a retracement, the buy was quickly confirmed by the moving average which started to move up and RSI went to above the 50 center line mark. Buying here after the retracement shows as a bitcoin trader your trade position did not have a lot of draw-down and you started to make money immediately henceforth making this a low risk trade.

Where to close buy orders

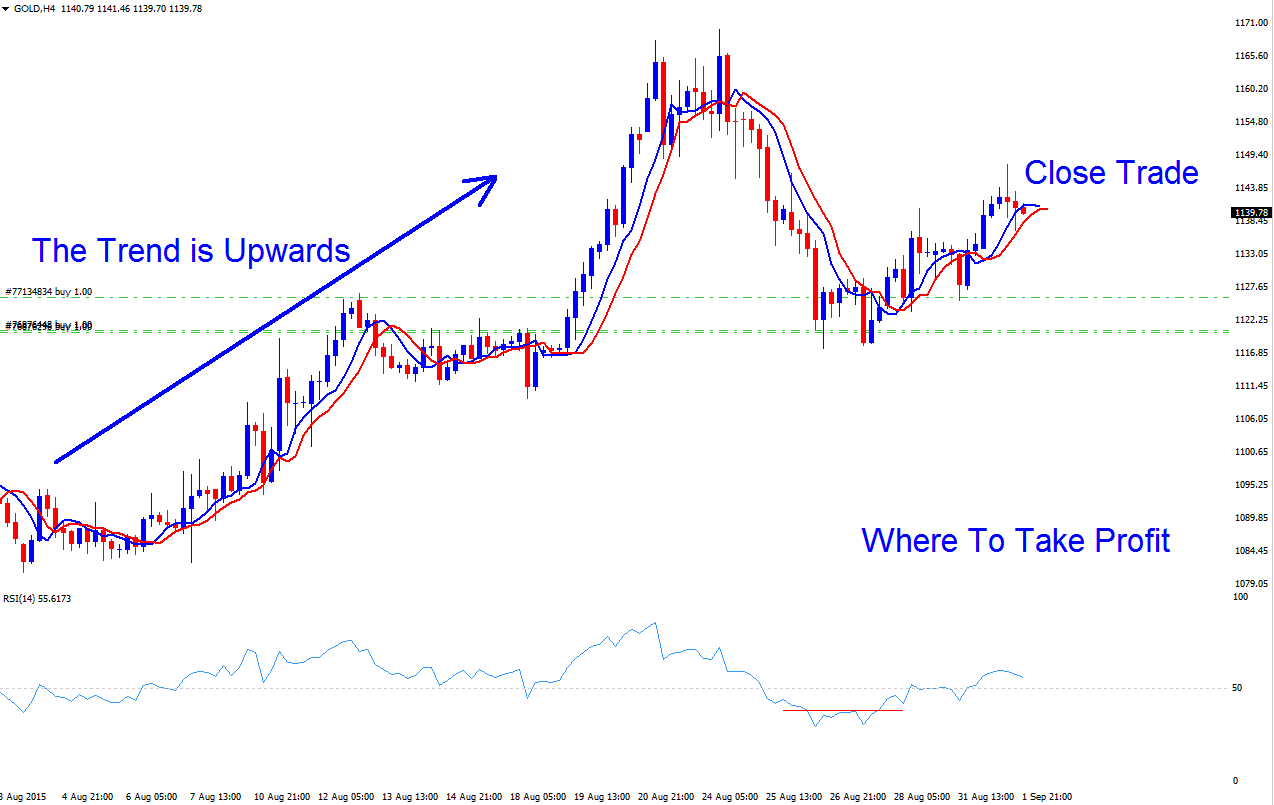

Knowing where to buy also means knowing where to close you orders and take profit.

For the above setup we will be using the RSI over-bought signal. Once the RSI goes above 70 and then close below this level we shall consider this as a sell cryptocurrency signal and we shall close all open buy orders.

And then wait for another retracement and open another buy order after a retracement and repeat this strategy.

We shall take a screen shot of this trade to show you where to close the orders after the btcusd trading market moves up as these trade is real time at the time of writing this article.

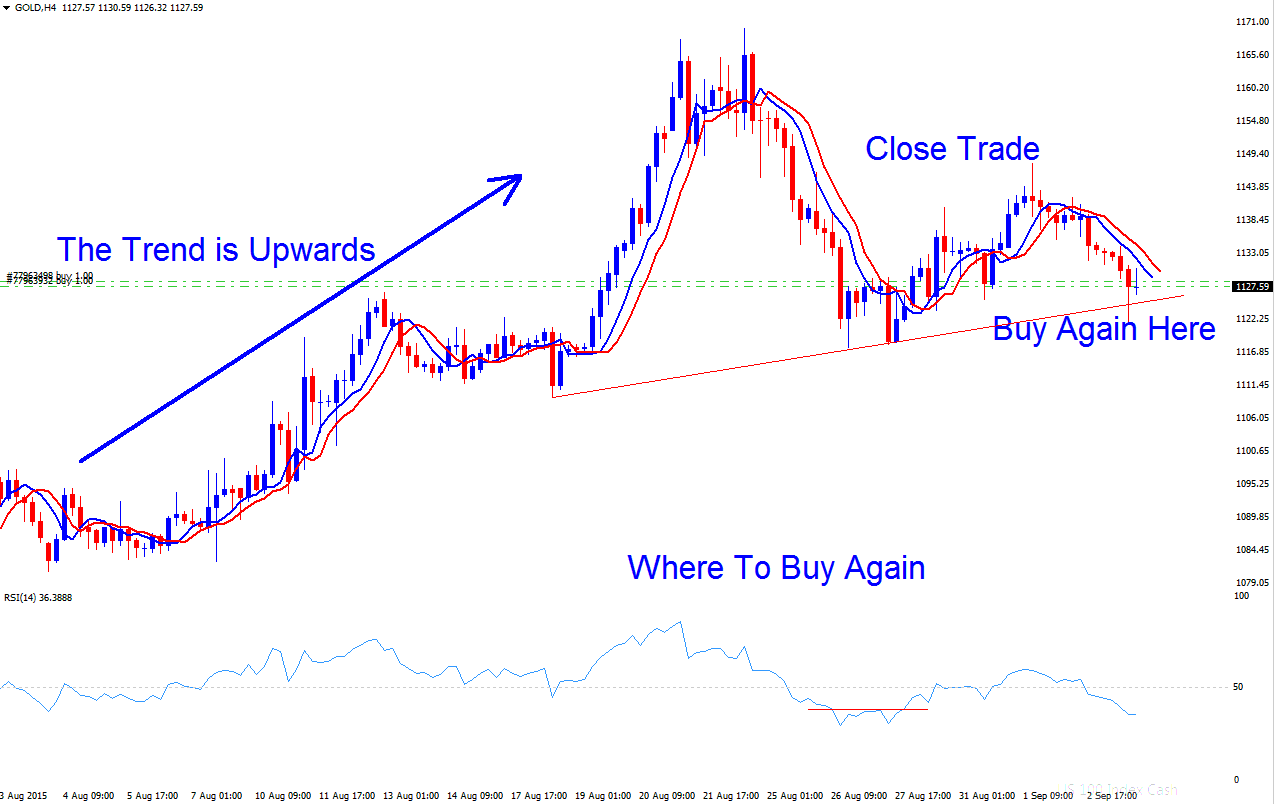

Where to buy again

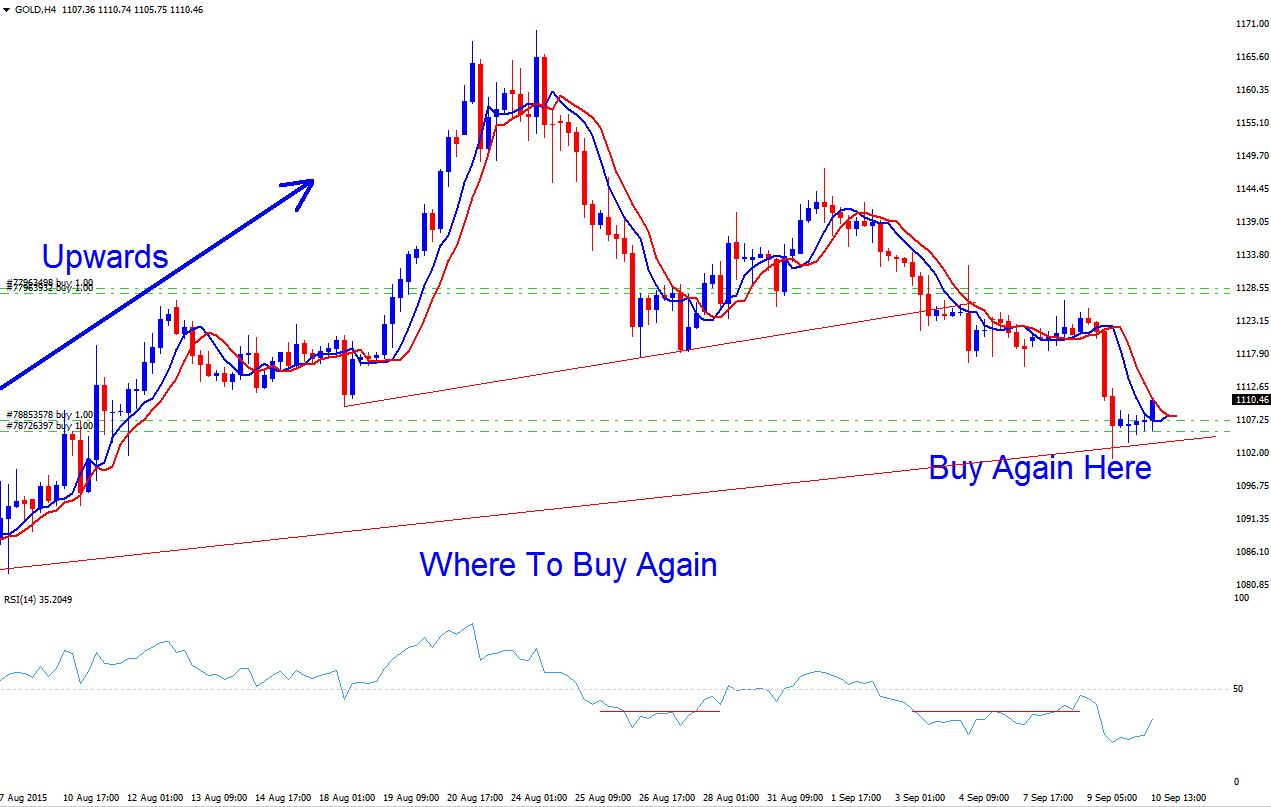

Because the bitcoin trend is upwards and we only buy after a retracement then as a buyer you would have waited for the setup to buy again and this is after a retracement.

This would have been best place to buy as this is the level where the prevailing market is over-sold.

You also can wait for confirmation of the above signal as shown below:

Buy trade set-up confirmed

What if a Trader Buys and The Retracement Continues Downward?

This is a good question, what if where you buy is not where the retracement stops and the down move continues?

This trade did just that and retraced 200 points down from our buy point as illustrated below.

So the first thing to know is that this is an upward bitcoin trend and the retracement has moved 671 pips from the top but using our strategy we've been caught by only 200 pips instead of the 671 pips. This is the first reason why you should not buy at the top & instead wait for a retracement then buy. That way you will only be caught by a fraction of the retracement & not the whole retracement, therefore saving you from a lot of drawdown on the position.

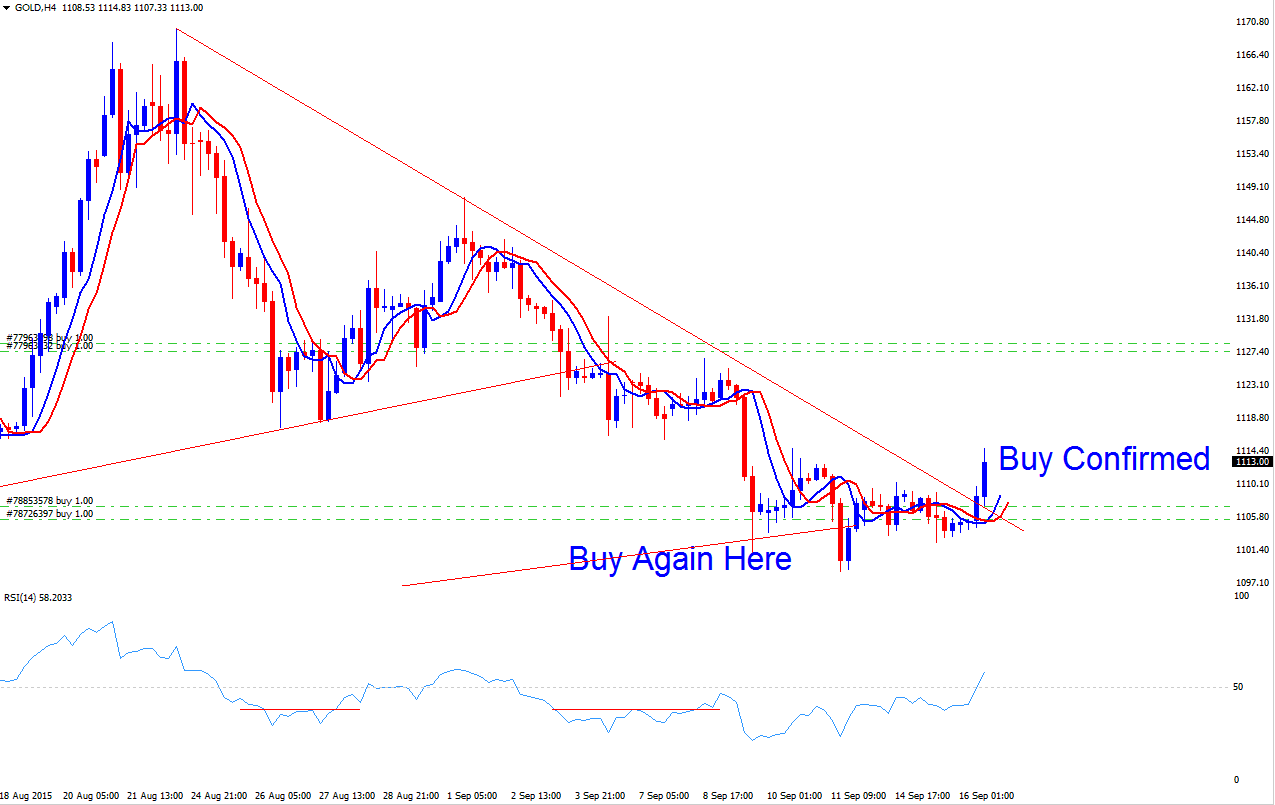

The next step is that because you will not be over leveraging your trade positions you'll still have enough money to absorb the drawdown. You will then open a new trade after this retracement starts to move upwards as illustrated above.

From above trade setup our newly opened trade went up by 70 points immediately after opening this trade. As a trader you'll need to close these new trades at the earliest times so that you can reduce your risk & at the same time book some profit amidst all the retracementspullbacks happening.

For this trade our take profit will be set at 1144 or we monitor the bitcoin price chart and close this trade if the momentum of this trades starts to slowdown.

We shall take a screenshot of this trade after the btcusd trading market bitcoin trend has developed.

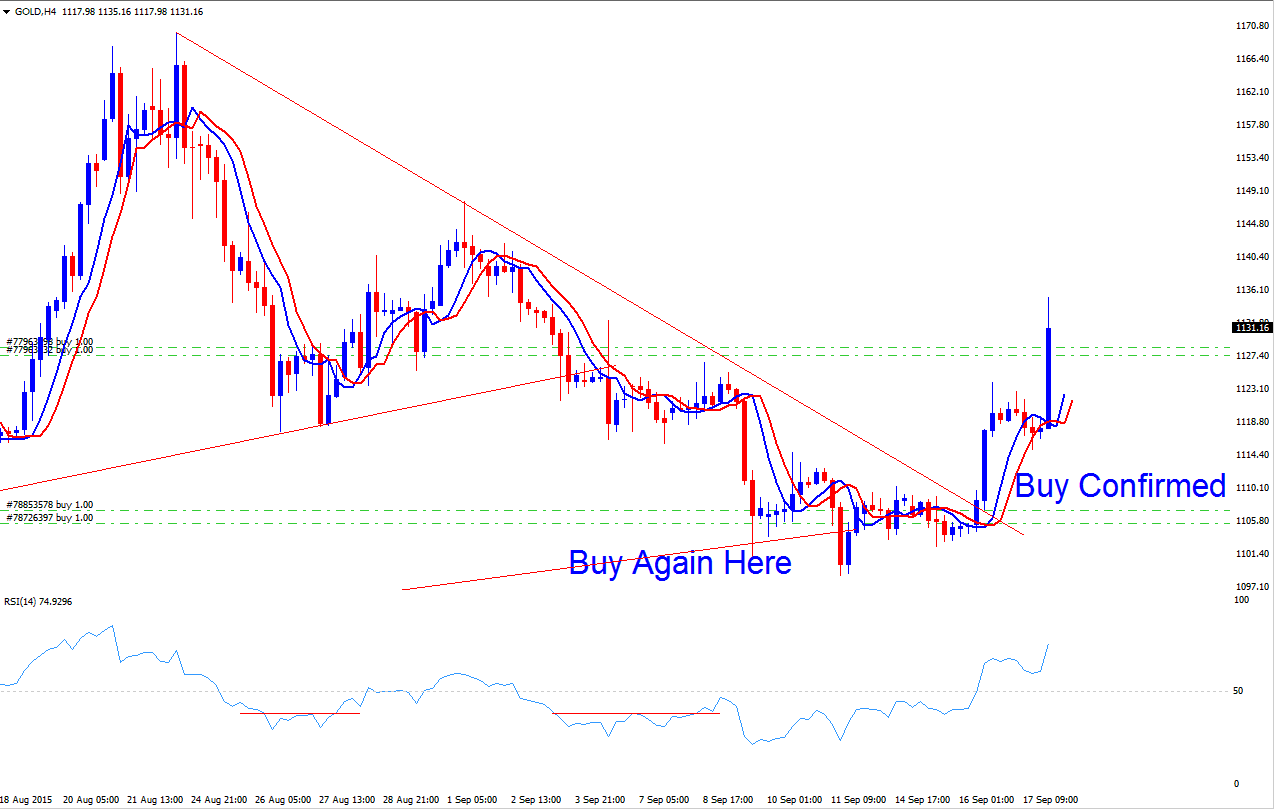

The buy bitcoin trade was confirmed after there was a consolidation - both moving averages are now heading upwards and the RSI indicator is above 50. There was even a short term downwards bitcoin trend as illustrated by the downward bitcoin trend line that has now been broken.

As a trader you can see that using our strategy we have been able to reduce our drawdown despite the short term down btcusd trend. Should the btcusd trading market go up to where our first trade transaction was, then we shall have added profit to our trading account. The reason why we have added this profit will not be because that we were able to perfectly time the btcusd trading market but because we have entered the btcusd trading market when the possibility of draw down is very minimal. This means our risk reward ratio is high enough to enable us to extract profit from the bitcoin market using this strategy.

The following area is where you close your trade, always quit while you are ahead and wait for another retracement to buy.

It is best to close trades here because the btcusd trading market is a little overbought at this particular time. Close trade set a buy limit and wait for tomorrow.

Based on our strategy the best place to set buy limit would be at 1123 or 1122 or 1121 just above 1120.

Just in case there's a continuation of this bullish upwards market, we also set buy stop pending order at 1136 just above most recent high that way our buy bitcoin trade will still be opened either way.

The thing to remember is retracement before buy - the aim is to first reduce any amount of draw-down before starting to chase profit.

The next thing you have to be sure with this strategy is that the current long term bitcoin trend is upwards, that way you're trading with the bitcoin trend - you can use moving average cross-over method on the weekly chart to do this.

The same concept of retracement before sell can be used to open sell cryptocurrency trades when in a downward bearish trending market.

Study More Tutorials & Courses:

- How to Select Automated Bitcoin Crypto Trade Robots

- How Do I Add Trading Linear Regression Trading Indicator on Chart?

- How Do I Analyze Chart Price Upward Trend?

- BTC USD Mini Account

- BTC USD Trading Indicators Trade Strategies

- How Do I Register a MT4 BTCUSD Account?

- How Do I Analyze a Sell Stop BTC USD Order & Sell Limit BTC USD Order?

- Parabolic SAR Combination of BTC USD Trading Indicators

- BTC USD MetaTrader 4 Chart Templates Different BTC USD Trade Strategies Templates Examples

- Acceleration/Deceleration (AC) AC BTC/USD Trading Indicator