How Do You Interpret Fib Retracement Levels Bitcoin Trading Analysis?

Bitcoin Trade Fibo Retracement Levels Bitcoin Analysis

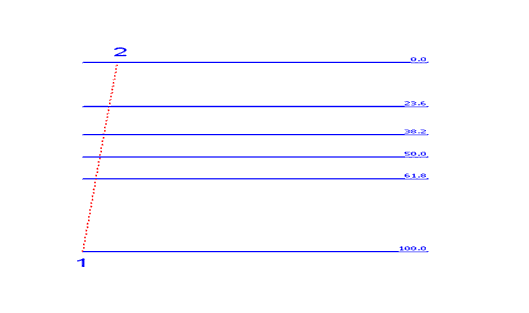

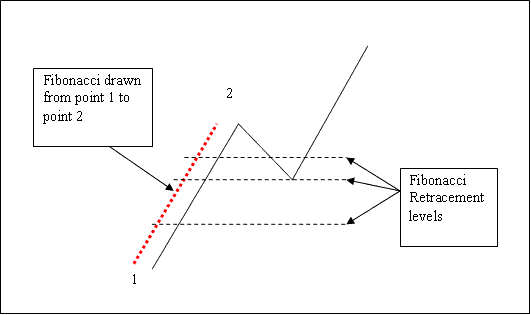

The Fibonacci retracement levels are explained below: traders should use this Fibonacci Retracement Levels bitcoin indicator to determine where to open a bitcoin trade whether a buy bitcoin trade in a upward trend and a sell bitcoin trade in a down ward trend.

How Do You Use Fib Retracement Levels for Intra-day Trading?

How Do I Use Fib Retracement Levels for Day Trading?

How Do I Use Fib Retracement Levels for Day Trading? - Fib Retracement Tool Described

How Do You Use Fibo Retracement Levels for Intra-day Trading? - Fib Retracement Tool Described

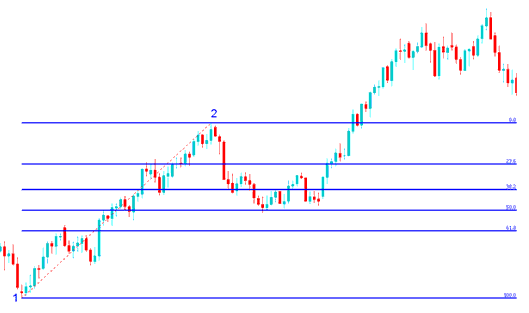

Bitcoin Upward Trend Method

In the analysis trading example illustrated below the bitcoin price is moving up between chart point 1 & chart point 2 then after chart point 2 it retraces down to 50.0% Fibonacci retracement level then bitcoin price continues moving up in the original upwards trend. Note that this bitcoin price retracement bitcoin indicator is drawn from point 1 to point 2 in direction of the Bitcoin trend (Upwards Direction).

Bitcoin Analysis of How Do I Use Fibonacci Retracement in an Upward Bitcoin Trend?

Analysis of How Do I Use Fib Retracement in an Up Bitcoin Trend?

Once the bitcoin price hit the 50.0 percentage% Fibonacci retracement zone, this Fib retracement zone provided a lot of support for the btcusd crypto price, and afterward bitcoin market then resumed the original upwards bitcoin trend & continued to move up.

For this trading analysis bitcoin trading example, the btcusd crypto price retracement reached the 50.0 percent% Fibonacci retracement zone, but most of the time the btcusd trading market will retrace up to 38.2% Fib retracement zone and therefore most of the time bitcoin traders set their buy limit bitcoin orders at the 38.2% Fib retracement level, while at the same time placing a stop just below 61.8 % Fibonacci retracement zone.

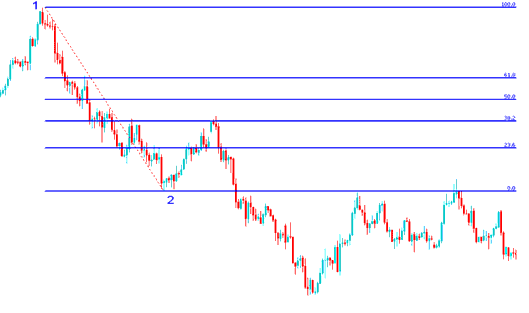

Bitcoin Downwards Trend Method

In the Bitcoin Retracement Strategy cryptocurrency trading example illustrated below the bitcoin market is moving down between chart point 1 & chart point 2, then after chart point 2 the bitcoin price then retraces up to 38.2% Fibonacci retracement level then it continues moving downward in the original downward trend. Note that this bitcoin price retracement bitcoin indicator is drawn from bitcoin chart point 1 to bitcoin chart point two in the direction of the Bitcoin trend (Down-wards Direction).

Bitcoin Analysis of How Do I Use Fib Retracement in a Downward Bitcoin Trend?

Analysis of How Do I Use Fib Retracement in a Downwards Bitcoin Trend?

The above analysis trading example is a bitcoin price retracement trading setup where the bitcoin price retraces immediately after touching the 38.20% Chart Fibonacci Retracement Level.

In this trading analysis example the bitcoin price pull back of bitcoin price reached 38.20% Fibo retracement level & did not get to 50.00% Fibo retracement level. It is always good to use 38.2 % Fib retracement zone because most times the bitcoin price retracement doesn't always get to 50.00% Fibo retracement level.

This Bitcoin Retracement provided a lot of resistance for the bitcoin price pull back, this was the best place for a trader to set a sell limit bitcoin order as the btcusd trading market quickly headed down after hitting this Fib retracement level.

How Do I Read Fib Retracement Levels Bitcoin Trade Analysis

Get More Lessons and Courses:

- How Do I Analyze BTC USD MetaTrader 4 Upwards Bitcoin Channel in MetaTrader 4 Platform?

- How to Trade BTC USD Using Leverage

- What's Support Resistance BTC USD Trading Indicator on MetaTrader 4 Bitcoin Charts?

- What's the Meaning of a BTCUSD Candlesticks?

- How Do I Predict BTC USD Chart Patterns Trend Reversal?

- How Bollinger Bands BTCUSD Trading Indicator Works BTC USD Strategies

- What are the Different Types of BTC USD Traders?

- What Happens in BTC USD Trade after a Ascending Triangle Chart Pattern?

- How Do I Analyze Position BTC USD with Different BTC USD Chart Time Frames?

- BTC USD Trade Technical Strategy Tutorial Guide