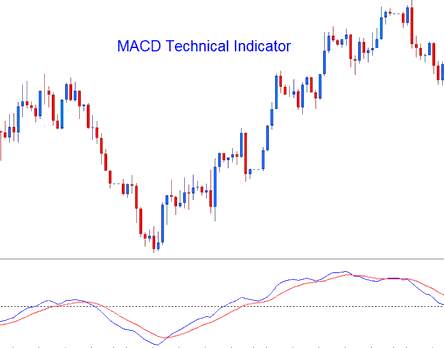

MACD

Developed by Gerald Appel,

The Moving Average Convergence/Divergence is one of the simplest, reliable, & most often used technical indicators.

It is a momentum oscillator and also a trend-following technical indicator.

Construction

The construction of this indicator calculates the difference between 2 moving averages & then plots that as "Fast" line: the second "Signal" line is then calculated from the resulting "Fast" line and then drawn on the same panel window panel as "Fast" line.

- "Fast" line - Blue Line

- "Signal" line - Red Line

The "standard" MACD values for "Fast" line is a 12-period exponential moving average and a 26-period exponential moving average MA and a 9-period exponential moving applied to the fast line, this plots the "Signal" line.

- FastLine = difference between 12 & 26 exponential MAs moving averages

- Signal Line = Moving Average of this difference of 9-periods

BTCUSD Analysis & How to Generate Signals

The MACD is commonly used as a trend-following indicator & works most effectively when analyzing trending market movements. Three common methods of using MACD to generate trade signals are:

BTCUSD Crossovers Bitcoin Signals:

FastLine/Signal Line Crossover:

- A buy cryptocurrency signal is generated when the Fast line crosses above the Signal line

- A sell cryptocurrency signal is generated when the Fast line crosses below the Signal line.

However, in a strong trending market this cryptocurrency signal gives a lot of whipsaws, the best cross over to use would thus be the Zero Line Crossover Signal that's less prone to whipsaws.

Zero Line Cross over Signals:

- When the Fast-line crosses above the zero center-line a buy bitcoin signal is generated.

- when the Fast-line crosses below zero center-line a sell bitcoin signal is generated.

Divergence Bitcoin Trading:

Looking for divergences between the MACD and bitcoin price can prove very effective in identifying potential reversal &/or bitcoin trend continuation points in bitcoin price movement. There two types of divergences:

- Classic Divergence Trading Signals

- Hidden Divergence Setup Signals

Overbought/Over-sold Conditions:

MACD indicator is also used to spot potential overbought/oversold conditions in bitcoin price action movements.

These levels are generated if the shorter MACD Lines separate dramatically from the median, this is an indication that bitcoin price action is over-extending & it will soon return to more realistic levels.

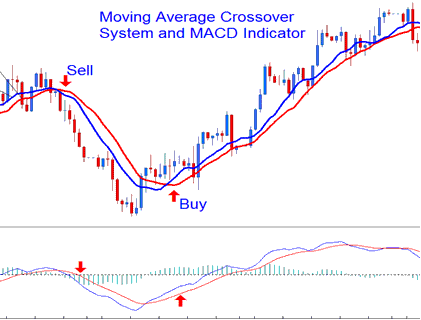

MACD & Moving Average BTCUSD Crossover Bitcoin Strategy

This btcusd indicator can be combined with others to form a cryptocurrency system. A good combination with the MA crossover strategy. A signal is generated when both give a signal in same direction.

Analysis in Bitcoin Crypto Trading

Learn More Courses & Lessons:

- Complete Learn Trade Tutorial Guide Learn Training Tutorial Guide

- Learn BTC USD Technical Analysis Guide

- Swing Trading 4 Hour BTC USD Trading Chart

- Adding Custom BTC/USD Technical Indicators

- How to Load BTC USD MT4 Trading Chart Template on MT4 Platform

- MT4 Trading System Tester Download Data

- How Can You Add Stop Loss BTC USD Order on Bitcoin Software?

- Best BTC USD Broker for BTC USD Trading Beginners

- How to Add Trade Parabolic SAR Indicator in Trading Chart

- How Can You Identify a Rising Wedge BTCUSD Pattern in Bitcoin Trading?