Parabolic SAR BTCUSD Analysis & Parabolic SAR Bitcoin Trade Signals

Developed by J. Welles Wilder.

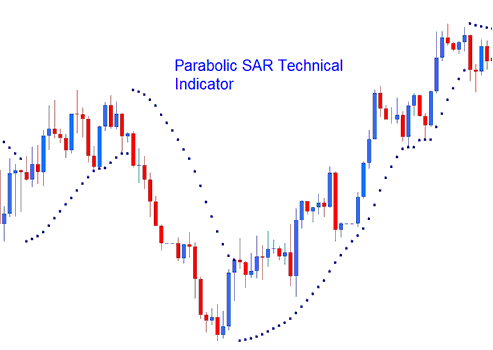

The Parabolic SAR is used to set trailing bitcoin price stops. This btcusd indicator is usually known as 'SAR' (stop-and-reversal) and it is used to follow bitcoin price action closely.

- In an Uptrend, the stop and reversal will trail below the btcusd market bitcoin price

- In a downward bitcoin crypto trend, the stop and reversal will trail above the btcusd market bitcoin price

BTCUSD Analysis & Generating Signals

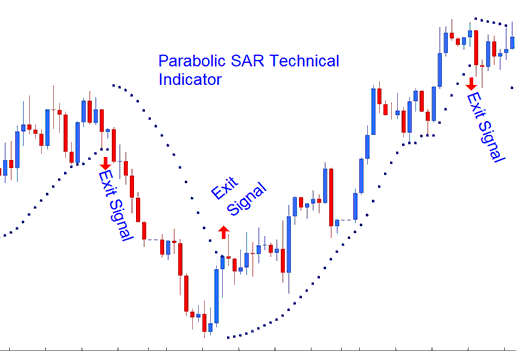

This btcusd technical indicator provides excellent exit points.

Exit BTCUSD Trade Signal for Buy trade transactions

Traders should close long positions when the bitcoin price falls below the trading indicator.

If you're trading long i.e. The bitcoin price is above the stop and reversal, the SAR will move up each day, regardless of direction that bitcoin crypto currency price action is moving. Movement of the indicator depends on the number of pips that bitcoin crypto currency prices move. When the SAR changes the direction then the btcusd market bitcoin trend also changes into downward. This generates the exit signal for long trade transactions.

Exit Bitcoin Signal for Sell trades

Traders should close short positions when the bitcoin price rises above the trading indicator.

If you're trading short i.e. The bitcoin price is below the stop and reversal, the SAR will move down every day, regardless of direction that bitcoin crypto price action is moving. Movement of the indicator depends on the number of pips that btcusd crypto prices move. When the SAR changes the direction then the btcusd market bitcoin trend also changes into upward. This generates the exit signal for short trades.

Exit Signal for Buy and Sell trade transactions

Learn More Tutorials & Courses:

- Japanese Candlesticks Patterns used on BTC USD Charts

- How to Use MetaTrader 4 Bitcoin Trade Demo Practice Account

- How Do I Analyze MetaTrader 5 Downwards BTCUSD Trend Line MetaTrader 5 Platform?

- BTC USD Trade a Consolidation BTC USD Pattern

- How to Set a Buy Stop BTC USD Trade Order on Platform Software

- Crypto Trade Sell Trade

- Bollinger Bands BTCUSD Trend Reversal BTC/USD Strategies

- BTC USD Trade Tips: How to Improve Results of BTC USD Strategy

- Set TP BTC/USD Trade Order on MetaTrader 4 Trading Platform

- What's the M Pattern in BTC USD Trade?