What is an Example of a Bitcoin Trend? Identifying Trends in Bitcoin Trading

A bitcoin trend in bitcoin trading is the tendency of bitcoin prices to move in a particular direction for a period of time in a general direction upwards or downward.

Trends can be interpreted using bitcoin trend lines.

Bitcoin Trend line analysis helps traders to define the direction of the market. Bitcoin Trend lines connect a series of bitcoin price highs or bitcoin price lows forming a slanting bitcoin trend that represents the general movement of the bitcoin price.

For an upward sloping line this is referred to as an up bitcoin trend - bitcoin trendline drawn is referred to as an upwards bitcoin trend line.

For a down-wards sloping line this is known as an down bitcoin trend - bitcoin trendline drawn is referred to as an downwards bitcoin trendline.

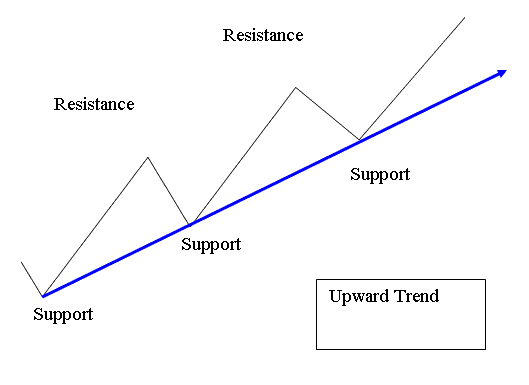

Upwards BTCUSD Trend Line

An upwards bitcoin trend line is drawn below the up-wards sloping pattern by connecting at least two lows. This will draw a bitcoin trend line which explains the general direction of the market upwards.

The example illustrated below shows how bitcoin price moves when it's heading in an up-ward trend. The bitcoin price will move up-wards forming support regions.

Since the btcusd market moves in a zig-zag manner bitcoin traders normally draw a bitcoin trend line which displays the general upwards bitcoin trend direction.

What's an Example of a Trend? Identifying Trends in Cryptocurrency - Crypto Trend Definition

An up bitcoin trend occurs when the bitcoin price makes consecutive higher bitcoin price highs & higher bitcoin price lows. Each bitcoin price high is higher than the prior bitcoin price high - higher high: HH, and each bitcoin price low is higher than the prior bitcoin price low - higher low: HL.

Up bitcoin trend lines gain more validity each time bitcoin price touches but does not penetrate it. An up bitcoin trend remains in place until this series of higher bitcoin price highs & higher bitcoin price lows is broken - bitcoin trend line break reversal bitcoin trade signal.

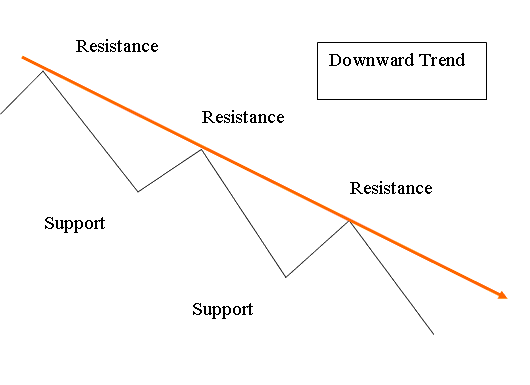

Downwards BTCUSD Trend Line

A downwards bitcoin trendline is drawn above the pattern formed by consecutive lower highs, it must connect at least two highs, with most recent high being lower.

Since bitcoin price moves down in a zig-zag manner traders normally draw a line which displays the general down ward direction. In bitcoin crypto market trading analysis, this overall direction is known as the BTCUSD Crypto TREND by traders. This down bitcoin trendline is drawn on Bitcoin chart showing the resistance areas (bearish bitcoin trend market move direction).

What's an Example of a Trend? Identifying Trends in Cryptocurrency - Crypto Trend Definition

A down btcusd crypto trend occurs when the btcusd crypto price forms a series of lower highs & lower lows. Each btcusd crypto price high is lower than the prior btcusd crypto price high - lower high, & each bitcoin crypto currency price low is lower than the prior bitcoin crypto currency price low - lower low: LL therefore showing bearish bitcoin crypto price movement.

Down bitcoin trend lines gain more validity each time bitcoin price touches but does not penetrate the bitcoin trend line. A down bitcoin trend remains the general direction til this series of lower bitcoin price highs & lower bitcoin price lows is broken - bitcoin trend line break reversal bitcoin trade signal.

Learn More Tutorials:

- How to Calculate Where to Place Stop Loss Order on a Trading Chart

- How Do I Analyze Fibo Pullback Levels BTC USD Trade Analysis?

- How to Analyze BTC USD Trade Fibo Extension Levels Strategies

- BTC USD Trade Platform Software MT5 Tutorial Guide for App

- BTC USD Training Course Tutorial Website Learn a BTCUSD Guide

- How Do I Predict BTC USD Trend Reversal Signals?

- What Happens in BTC USD after a Morning Star Candles?

- How Do I Add a Bitcoin Trade Trend Line on BTC USD Charts?

- How to Add Trading Market Facilitation Index Trading Indicator in Chart

- BTC USD Stop Loss Order Setting: Points to Remember When Setting BTC/USD Stop Loss Orders