Trading Short Term & Long Term Bitcoin Price Period of MA

A trader can choose to adjust the bitcoin price periods used to calculate the moving average.

If a trader uses short bitcoin price periods then the Moving Average will react faster to the changes in bitcoin price.

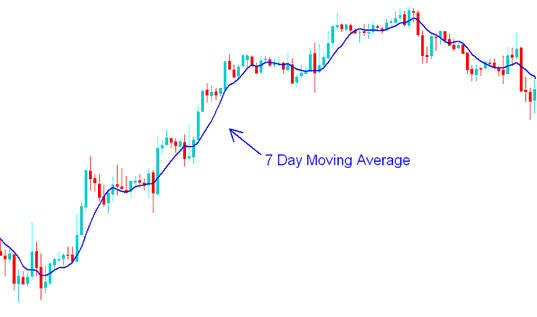

For example if a trader uses the 7 day bitcoin trading moving average then, the moving average indicator will react to the bitcoin price change much faster than a 14 day or 21 day bitcoin trading Moving Average would. However, using short time bitcoin price periods to calculate the Moving Average might result in the indicator giving false bitcoin trading signals (whipsaws).

7 Day Moving Average - Moving Average Bitcoin Methods

If another trader uses longer chart time periods then Moving Average will react to bitcoin price changes much slower.

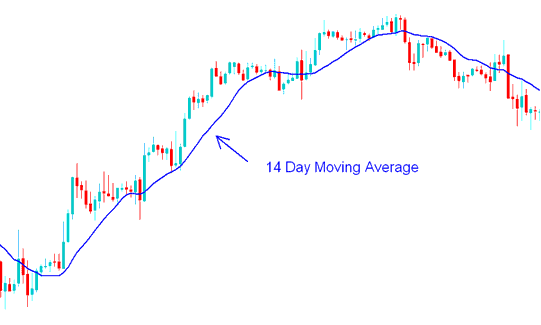

For example, if a trader uses the 14 day Moving Average indicator then average will be less prone to whipsaws but it'll react much slower.

14 Day Moving Average - Moving Average Bitcoin Strategy Example

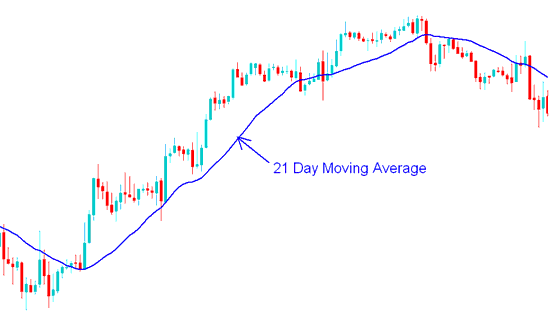

21 Day Moving Average - Moving Average Bitcoin Strategies Example

Study More Lessons & Topics:

- How Can You Add On Balance Volume Bitcoin Technical Indicator in Trading Chart in MT4 Platform?

- How Can You Use Trading Fibonacci Pullback Levels in MT5 Trade Software?

- How Can You Display BTC USD Trading Instruments in MT4 Tutorial?

- Exit BTC USD Signals & Setting Stop Loss BTC USD Order Levels

- Chandes QStick BTC USD Indicator Trading Analysis in Bitcoin Trading

- Different Types of Bitcoin Trading Accounts Described