RSI Indicator Trading Strategy

- RSI Overbought and Over-sold Levels

- RSI Divergence Setups

- RSI Classic Bullish & Bearish Divergence

- RSI Hidden Bullish & Bearish Divergence

- Swing Failure Strategy Method

- RSI Cryptocurrency Chart Patterns Bitcoin Trendlines

- RSI Summary

RSI Indicator Strategy

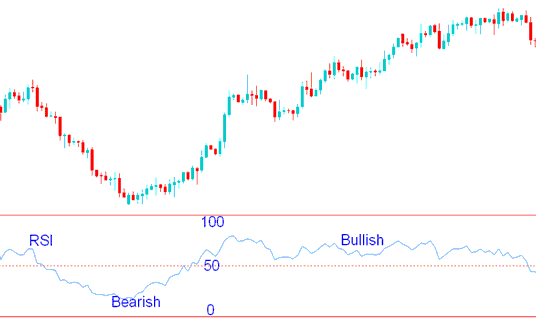

RSI or RSI is one of the most popular indicator used in bitcoin trading. It's an oscillator trading which oscillates between 0 -100. This a bitcoin trend following indicator. It indicates the strength of the btcusd crypto currency trend, values above 50 indicate a bullish bitcoin trend while values below 50 indicate bearish Bitcoin trend.

RSI Bitcoin Indicator Measures Momentum of a Bitcoin Trend.

The center-line for the RSI is 50 cryptocurrency indicator, crossover of the center-line indicate shifts from bullish to bearish bitcoin trend & vice versa.

Above 50, the buyers have greater momentum than the sellers and bitcoin price on the chart will keep going up as long as this RSI cryptocurrency indicator stays above 50.

Below 50, the sellers have greater momentum than the buyers and bitcoin price on the trading chart will keep going downwards as long as RSI cryptocurrency indicator stays below 50.

RSI Cryptocurrency Indicator - How to Trade Bitcoin with RSI Technical Indicator

In the trading example above, when the indicator is below 50, the bitcoin price kept moving in a downward market trend. The bitcoin price continues to move down as long as RSI indicator was below 50. When the RSI cryptocurrency indicator moved above 50 it showed that the momentum had changed from sell to buy and that the downward bitcoin trend had ended.

When the RSI cryptocurrency indicator moved to above 50 the bitcoin price started to move upwards and the bitcoin trend changed from bearish to bullish. The chart bitcoin price continued to move upwards and the RSI indicator remained above 50 afterwards.

From the trading example above, when the bitcoin trend was bullish sometimes the RSI would turn downwards but it would not go below 50, this shows that these temporary moves are just retracements because during all these time the bitcoin price bitcoin trend was generally upwards. As long as RSI indicator does not move to below 50 the current bitcoin trend remains intact. This is the reason the 50 center line mark is used to demarcate the signal between bullish and bearish bitcoin signals.

The RSI cryptocurrency technical indicator uses 14 day period as the default period, this is the period recommended by J Welles Wilders when he introduced it. Other oftenly used periods used by Bitcoin traders are the 9 & 25 day moving average.

The RSI technical indicator period used depends on the crypto chart time frame you are using to trade, if you're using day time-frame the 14 period will represent 14 days, while if you use 1 hour crypto chart timeframe the 14 period will represent 14 hours. For our examples we shall use 14 day moving average, but for your trading you can substitute the day period with the chart time frame you are bitcoin trading with.

To Calculate RSI Indicator:

- The number of days that a cryptocurrency market is up is compared to the number of days that the btcusd trading market is down in a given time period.

- The numerator in the basic formula is an average of all the bitcoin trading sessions that finished with an upward bitcoin price change.

- The denominator is an average of all the down bitcoin trading sessions closes for that period.

- The average for the down days are calculated as absolute numbers.

- The Initial RSI is then turned in to an oscillator indicator.

Sometimes very large up or down movement in bitcoin price in a single bitcoin trading session bitcoin price period may skew the calculation of the RSI average and produce a false signal - whipsaw signal - in the form of a spike.

RSI Centerline: The center-line for this technical indicator is 50. A value above 50 implies that the btcusd trading market bitcoin trend is in a bullish phase as average gains are greater than average losses. Values below 50 indicate a bearish phase in the btcusd trading market bitcoin prices are in general closing lower than where it's that they opened.

Overbought & Over-sold Levels: Wilder set the RSI overbought and oversold levels at which the btcusd trading market moves are overextended at 70 and 30.

Get More Topics:

- What Happens in Bitcoin Trading after a Ascending Triangle Chart Pattern?

- The How to Setup Tutorial for MetaTrader 4 Trading App

- How Can You Analyze & Login to MT4 Trading Software?

- Inverted Hammer Candlestick & Shooting Star Candlestick Pattern

- BTCUSD Trading Pin Bar BTC USD Price Action Patterns Trading Indicator Combined with Fibo Pullback Levels Trading Indicator